- Tech News's Newsletter

- Posts

- Warren Buffett & Bill Gates Team Up to Transform Nuclear Power As Uranium Market Points To Higher Prices

Warren Buffett & Bill Gates Team Up to Transform Nuclear Power As Uranium Market Points To Higher Prices

Two of the world’s richest investors are bullish on the future of nuclear power and technology. Bill Gates’ private nuclear energy start-up, TerraPower, recently broke ground on its $4 billion nuclear facility in Wyoming, a project co-sponsored by Warren Buffett. As market leaders continue to invest more in nuclear energy production, the value of uranium and its producers is expected to rise significantly.

TerraPower is among several billionaire-backed companies aiming to create a new generation of small modular reactors (SMRs). SMRs are planned to be mass-produced and can be assembled virtually anywhere. TerraPower’s SMRs are unique due to their liquid metal cooling method, simpler and cheaper design, and ability to be constructed quickly to meet power needs and balance the grid.

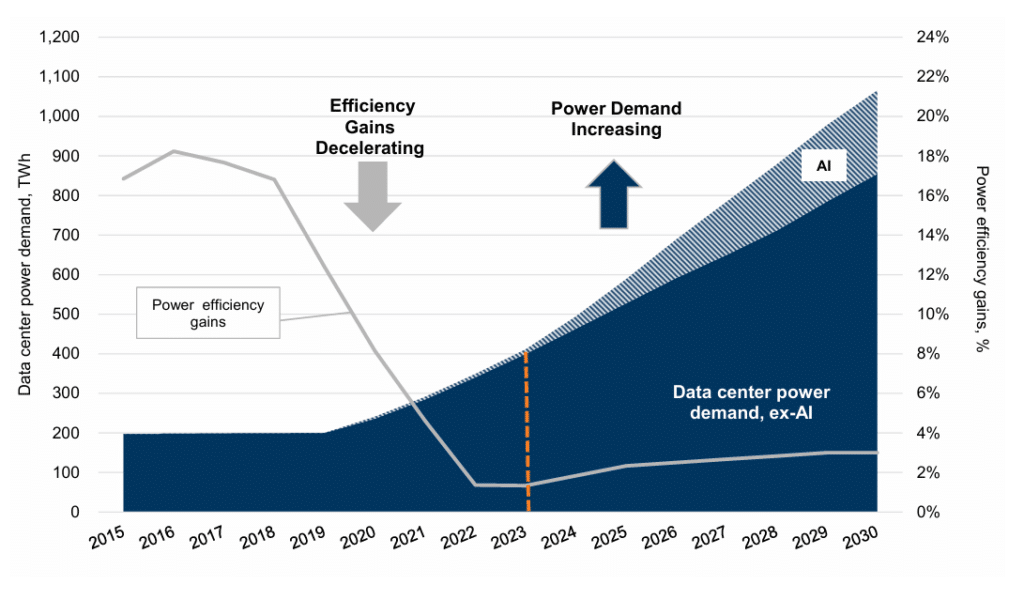

The surge in electricity demand from emerging technologies such as AI is forecasted to increase exponentially. For the first time in years, energy demand growth in the developed world has surpassed that of developing countries. The International Energy Agency (IEA) estimates that electricity demand from AI data centers could increase more than tenfold by 2026.

Warren Buffet has a phenomenal track record for picking companies in industries primed for major growth. However, TerraPower is a private company, so investors cannot buy shares in it yet. Additionally, civilians cannot purchase physical uranium for safety and regulatory reasons. Instead, smart investors are getting ahead by buying up undervalued uranium stocks like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) to profit from their expected triple-digit gains.

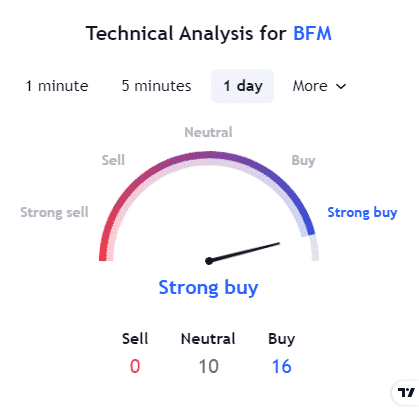

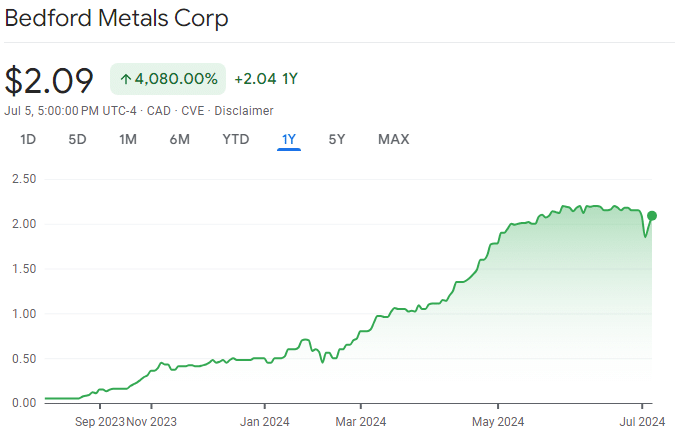

Based on AI-driven analysis, stock performance, and market trends, News by Ai ranks Bedford Metals as the top mining stock for 2024. The company’s stock price has grown impressively by 4,080% over the past year due to its strategic acquisitions in the Athabasca Basin.

Current exploration and further expansion are anticipated to increase Bedford’s stock price by 850% in 2024. Having already achieved a 318% growth this year, our AI forecasts a robust upward trajectory for the stock as the company expands.

At News by Ai, we use AI models to analyze stock data, news trends, and market forecasts to identify top-performing stocks. Investment banks like JP Morgan have already deployed AI-assisted investment decision tools such as IndexGPT to find lucrative stock opportunities by analyzing financial news and trends.

Bill Gates’ TerraPower Plans To Build New Generation Nuclear Plant

TerraPower intends to construct a new wave of nuclear power plants in the US. The company is competing with Russian and Chinese firms to develop and export more cost-effective reactors. Its new generation sodium-cooled SMR is a game changer in nuclear reactor design and can be built for around half the cost of traditional water-cooled reactors.

Microsoft founder Bill Gates has already invested over $1 billion in TerraPower. Recently, he stated he is ready to continue investing billions in the company’s upcoming nuclear facility and next-generation SMR technology as the world’s energy demand grows. The company also raised nearly $1 billion in private funding and $2 billion from the US government, along with an agreement with the UAE to provide SMRs.

Chris Levesque, CEO of TerraPower, brings over 30 years of nuclear experience to lead the company’s innovative reactor projects. His career as a senior engineer on U.S. Navy nuclear submarines, as well as his extensive background in operating small nuclear power plants and managing complex projects, underscores his proven expertise in planning and implementation.

Uranium Stocks Surge Amid Tight Supplies and Growing Nuclear Demand

Only a handful of regions, like Canada, Kazakhstan, and Australia, produce significant quantities of uranium. Russia will be off-limits on August 11th due to US sanctions, which will push prices up. Major recent investments in Canada’s prime uranium-producing region have put Canada on track to reclaim the title as the world’s leading uranium producer in the next decade.

There are 61 nuclear power plants currently being built worldwide. Additionally, about 90 are in the planning phase, and over 300 have been proposed. There has also been a trend to restart previously closed plants in regions.

Among the many recent developments, South Korea is investing $216 million in a small modular reactor (SMR) hub, Sweden is planning an SMR project to host up to six reactors, and Norway is setting up a committee to explore nuclear power options for the country. At the same time, Japan and the US plan to restart decommissioned power plants.

Another key trend in the nuclear revival is the forecast ramp-up of power demand due to the booming AI and data center sectors. Goldman Sachs forecasts that AI and data center power demand will double by 2030. With no other satisfactory clean alternatives besides nuclear power, this energy demand is driving significant investments from the tech sector and boosting the nuclear sector’s growth.

Data Center Electricity Demand Forecast

Source: Masanet et al. (2020). Cisco, IEA, Goldman Sachs Global Investment Research

The market’s optimistic outlook on uranium prices has led to increased mergers and acquisitions (M&A) activity in uranium-rich areas like Canada’s Athabasca Basin. In June, Australia’s Paladin Energy agreed to buy Canada’s Fission Uranium Corp. for an implied equity value of C$1.14 billion. This is the largest of the dozens of acquisitions in the region so far this year.

This Gold Miner’s Uranium Play Positions Its Stock for an 850% Upswing

Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a junior mineral exploration company with significant growth potential in 2024 due to its existing gold project and strategic uranium project acquisitions. Its stock is experiencing major growth, surging 318% since the beginning of this year. Strategic acquisitions and rising uranium prices, up more than 50% since last year, have driven its recent growth.

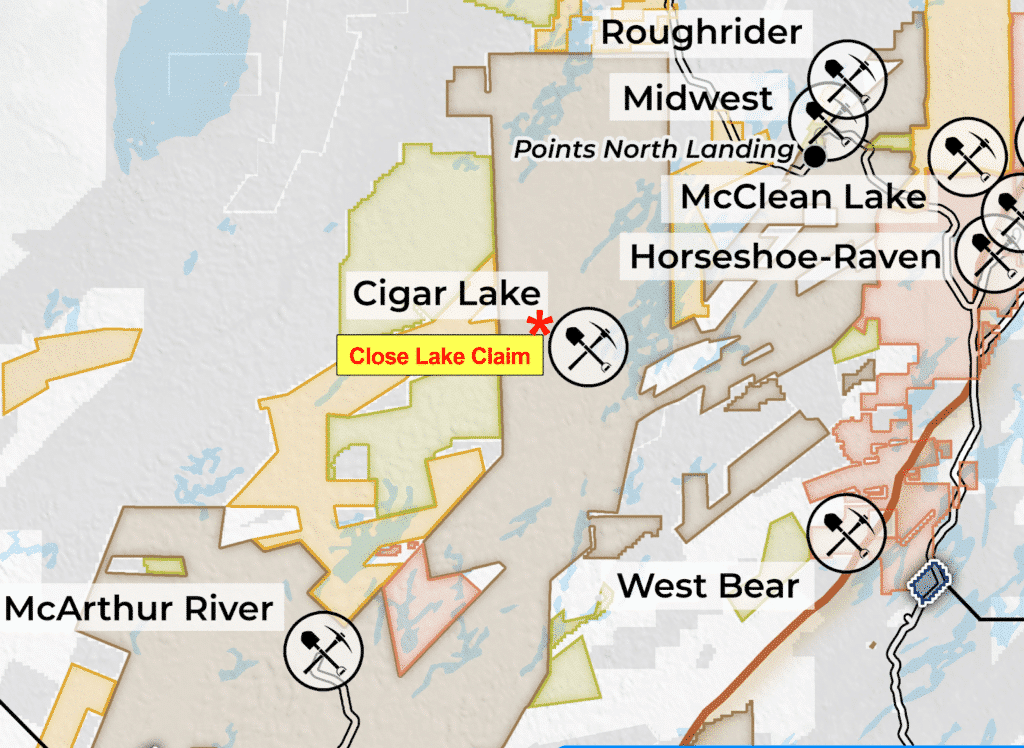

Rising commodity prices encourage miners to focus on growth through new projects, expansions, mergers, and acquisitions. On May 21, Bedford announced its acquisition of the Close Lake Uranium Project in the Athabasca Basin. This acquisition is the company’s second uranium project in the region this year, following the Ubiquity Lake Uranium Project in April.

In its July 3rd press release, the company announced that it is completing due diligence for its third planned acquisition of the year, the Sheppard Lake Uranium Project, which neighbours its Ubiquity Project.

Bedford’s Close Lake project is on the eastern side of the Athabasca Basin. The 245-hectare claim is in a prime exploration corridor, known for its rich uranium deposits and proximity to the Cigar Lake and McArthur River mines. Cameco’s McArthur River Mine, the world’s largest and highest-grade uranium deposit, contains 255 million pounds of U3O8 with an average grade of 17.33%.

Bedford Metals – Close Lake Claim

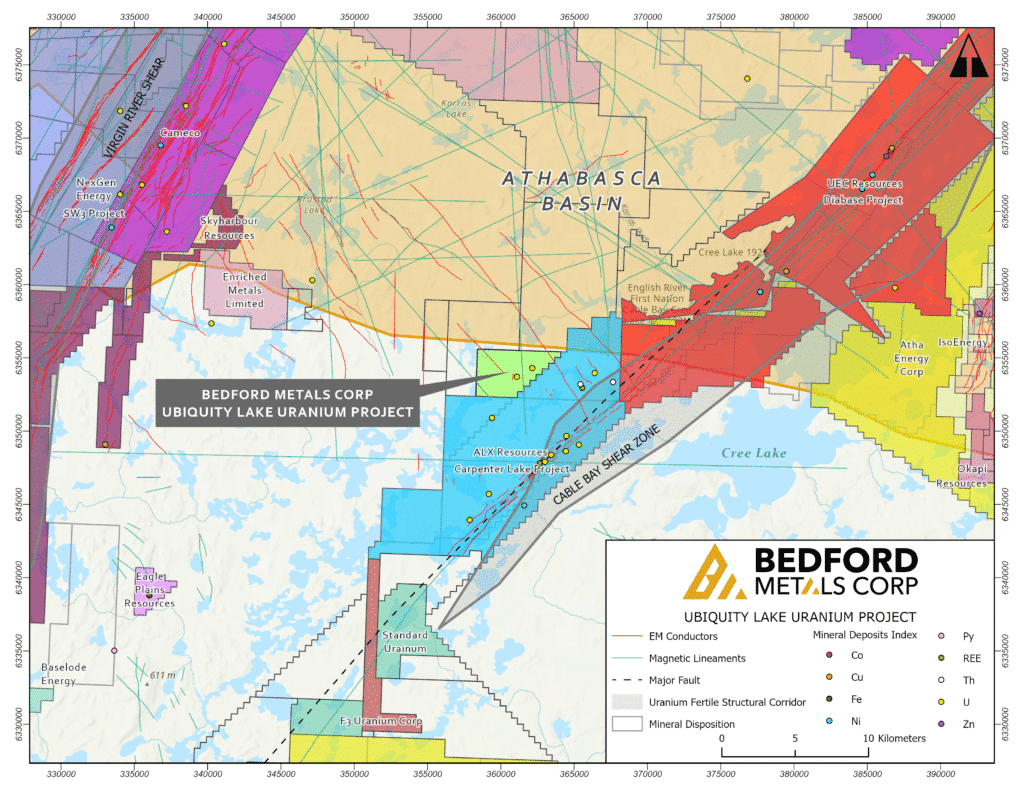

The company’s Ubiquity Lake project is next to major uranium projects, including ALX Uranium’s Carpenter Lake Project and Uranium Energy Corp’s Diabase Project. The project is also near Cameco’s Centennial uranium deposit and important geological formations, like the Cable Bay and Virgin River Shear Zones.

Bedford Metals – Ubiquity Uranium Claim

Bedford’s press releases show that the company plans to continue its intensive 2024 exploration agenda and announced a multi-phase work program for the Ubiquity project. This program involves VTEM (Time Domain Electromagnetic) surveys in Phase 1 and ground radiometric surveys in Phase 2.

As the demand for uranium skyrockets, investing in the nuclear energy market will offer profits for everyone: including retail investors, major banks, billionaires, and tech companies. While the clean power generated from nuclear energy will benefit all of society in the future, it will benefit early investors in uranium companies the most.

|

|

Reply