- Tech News's Newsletter

- Posts

- Uranium Stocks Outperform Tech Stocks as Amazon & Microsoft Invest in Nuclear Energy

Uranium Stocks Outperform Tech Stocks as Amazon & Microsoft Invest in Nuclear Energy

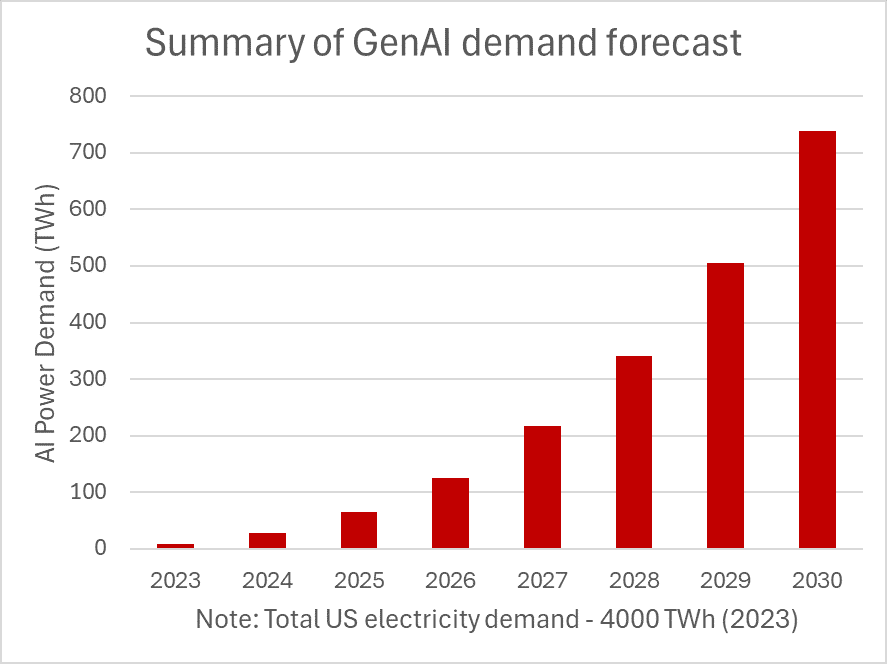

The stock market has greatly benefited investors in AI and related industries, with software, semiconductors, energy, and mining companies experiencing triple-digit stock price growth. With AI projected to require a quarter of all U.S. electricity by 2030, Big Tech firms like Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT) have established a lead in securing new nuclear-powered data centers to meet their growing energy needs.

In March, Amazon Web Services (AWS) purchased the Cumulus Data Center, a nuclear-powered data center in Pennsylvania, for $650 million. This is part of a multi-billion dollar plan to build a nuclear-powered data center campus. Nvidia (NASDAQ: NVDA) anticipates that companies may invest up to $1 trillion over the next four years to upgrade and expand data center infrastructure to meet the growing demand from AI applications.

In January, Microsoft hired a director of nuclear technologies and is now planning to build a $100 billion nuclear-powered data center project for itself and OpenAI to help develop artificial intelligence models. In addition, Bill Gates’ startup, TerraPower, recently started constructing its Sodium-cooled nuclear reactor to revolutionize power generation.

Small modular reactor (SMR) technology advancements have made it simpler and more cost-effective to develop local energy sources. Countries like Canada are leading the way in SMR development by completing the first construction phase of a new SMR east of Toronto.

The resurgence of nuclear power has reignited interest in uranium, with prices soaring 233% in just five years. Investors looking to capitalize on this bull market should consider undervalued uranium companies like Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF), which are strategically placed to take advantage of the increasing demand for uranium.

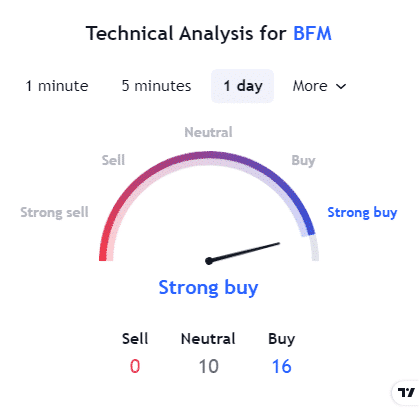

TradingView – Technical Analysis for BFM

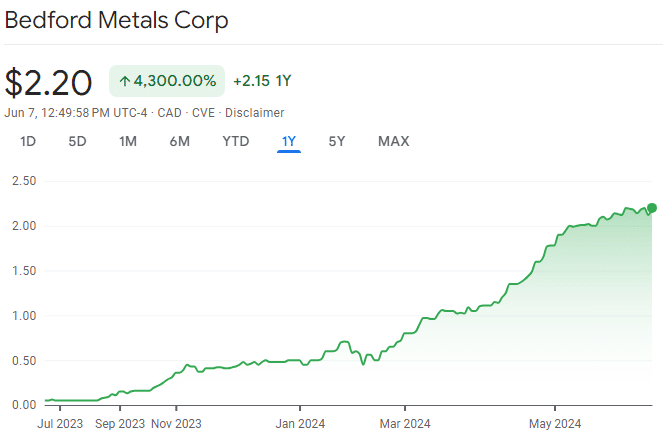

Based on AI-driven analysis, stock performance, and market trends, News by Ai ranks Bedford Metals as the top mining stock for 2024. The company’s stock price has grown an impressive 4,300% over the past year due to its strategic acquisitions in Canada’s prime uranium mining region, the Athabasca Basin.

Ongoing exploration and further expansion are anticipated to increase Bedford’s stock price by up to 800% in 2024. Having already achieved 340% growth this year, our AI forecasts a robust upward trajectory for the stock as the company expands.

Google Finance – BFM Stock Graph

At News by Ai, we use AI models to analyze stock data, news trends, and market forecasts to identify top-performing stocks.

The AI Industry Is Driving a Nuclear Power Renaissance

OpenAI’s latest version of ChatGPT uses as much electricity daily as 180,000 U.S. households. In addition, it’s estimated that half a litre of water is needed per conversation to cool down its servers. With AI’s rapid growth, tech companies must invest heavily to expand their data center capacity to maintain their lead.

Source: Wells Fargo Securities, LLC Estimates

Currently, the latest data centers typically require around 30MW of electricity, while those under development request as much as 90MW. Additionally, AI data centers for training AI models can consume 5–7 times more energy than traditional data centers.

The International Energy Agency (IEA) emphasizes this urgency, estimating that electricity demand from AI-specific data centers could increase more than tenfold from 2023 levels by 2026.

AI data centers require substantial electricity, water for cooling, and a skilled workforce that prefers urban living. On-site electricity generation is critical for AI operations to ensure reliable and continuous power supply. To meet these needs, tech firms are investing in nearby nuclear power infrastructure rather than depending on distant or unreliable sources like wind or solar power.

Amazon’s recent investments in its nuclear-powered data centers in Pennsylvania highlight the strategic value of nuclear-powered real estate. The company stated that it plans to build 15 new data centers in the area. Amazon “purposely chose this site because of the proximity to the power,” an Amazon Web Services real estate representative said.

Microsoft’s commitment to nuclear-powered solutions also reflects a broader trend in the tech sector. Its planned 100 billion nuclear-powered datacenter project with OpenAI is part of a larger shift toward nuclear energy. Last summer, Microsoft partnered with Constellation Energy to supply nuclear power to a data center in Virginia.

Thanks to heightened demand for nuclear power, uranium has experienced an upward price adjustment over the past five years. Over the last 12 months, uranium prices have increased over 50%, with many mining companies like Bedford Metals following impressive stock gains during the same period.

Trading Economics – Uranium Spot Price

As tech and semiconductor stocks benefit from the AI boom, the most undervalued opportunities are found in nuclear mining companies, which will provide the necessary power for these industries for decades.

The Best Opportunity To Profit From Uranium As AI Continues to Demand More Fuel

Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a junior mineral exploration company with significant growth potential in 2024 due to its existing projects and strategic acquisitions in Canada, the second-largest uranium-producing country in the world.

Its stock has experienced an impressive 4,300% increase in the past year and 340% year-to-date. As the company continues to expand rapidly, the stock shows no signs of slowing down.

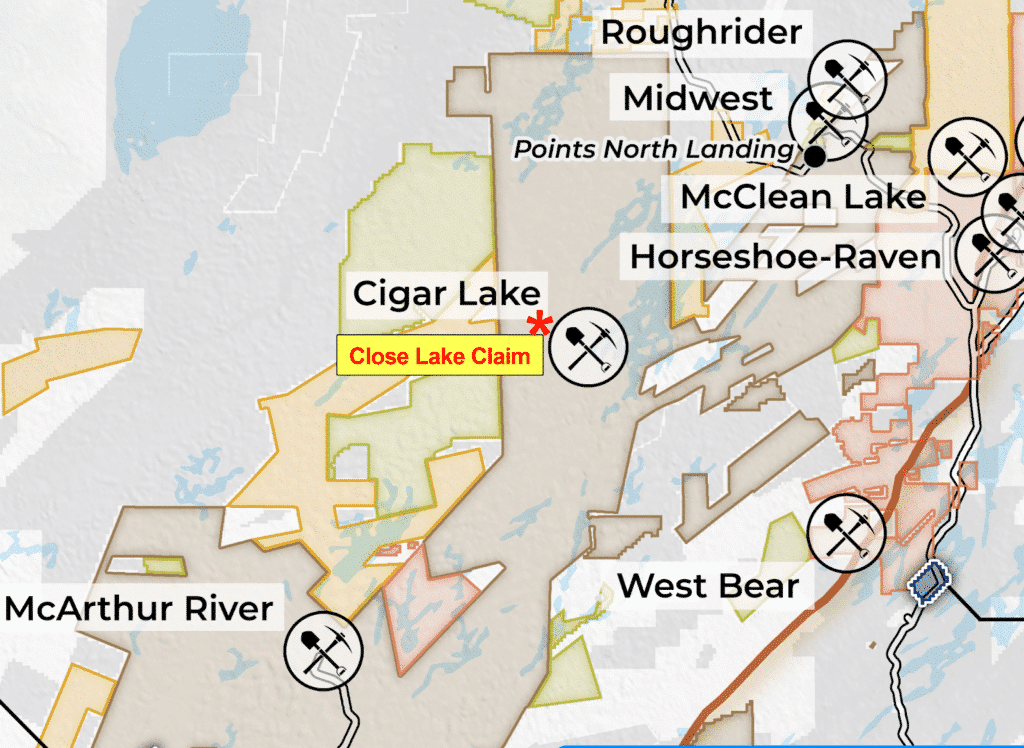

On May 21, Bedford announced its acquisition of the Close Lake Uranium Project in the Athabasca Basin, Canada’s leading uranium-producing region. This marks the company’s second uranium acquisition this year, following the Ubiquity Lake Uranium Project in April.

Bedford’s Close Lake project is on the eastern side of the Athabasca Basin. The 245-hectare claim is in a prime exploration corridor, known for its rich uranium deposits and proximity to the Cigar Lake and McArthur River mines. Cameco’s McArthur River mine, the world’s largest and highest-grade uranium deposit, contains 255 million pounds of U3O8 with an average grade of 17.33%.

Bedford Metals – Close Lake Claim

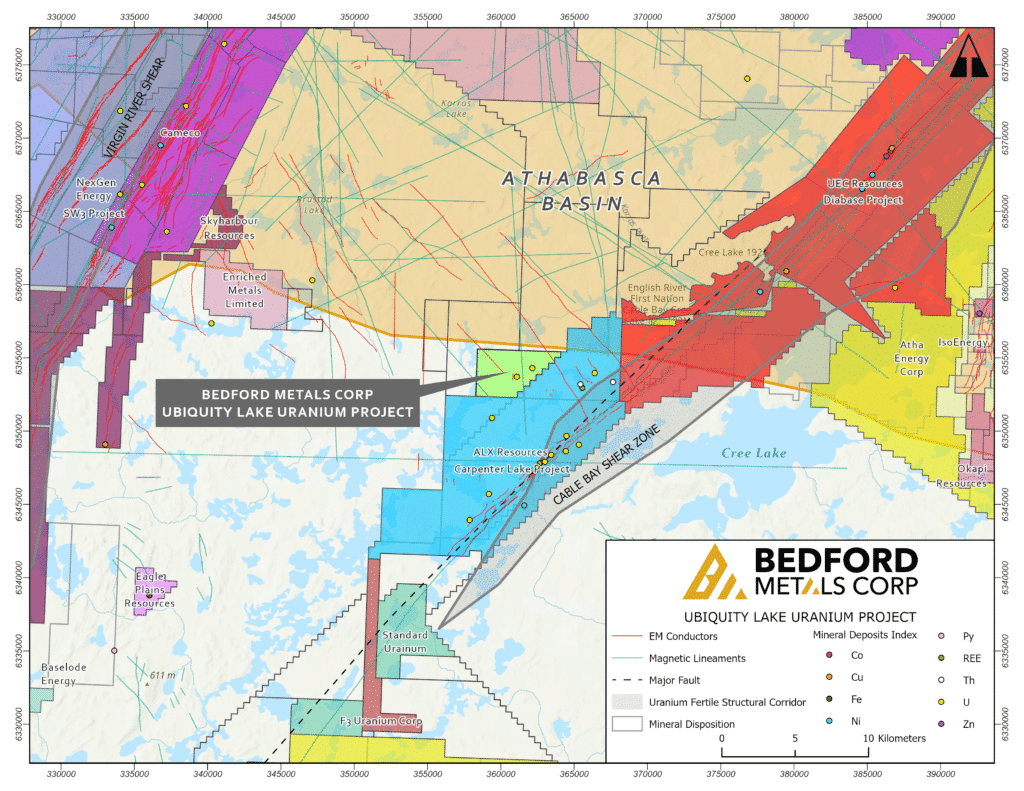

The company’s Ubiquity Lake project is adjacent to major uranium projects such as ALX Uranium’s Carpenter Lake Project and Uranium Energy Corp’s Diabase Project. The project is also close to Cameco’s Centennial uranium deposit, located near key geological formations such as the Cable Bay Shear Zone and the Virgin River Shear Zone.

Bedford Metals – Ubiquity Uranium Claim

Bedford Metals recently announced a multi-phase work program for the Ubiquity project involving VTEM (Time Domain Electromagnetic) surveys in Phase 1 and ground radiometric surveys in Phase 2.

Bedford’s press releases show that the company plans to continue its intensive 2024 exploration agenda. With its current undervalued stock price and its calculated expansion efforts, Bedford is poised for significant share price growth.

As the AI industry continues to drive demand for nuclear power, uranium prices are expected to continue to rise. While it may be too late to profit massively from some of today’s leading AI companies, there is still time to invest in the companies that will power them.

|

Reply