- Tech News's Newsletter

- Posts

- This Stock Is Primed for an 850% Surge As Goldman Sachs Declares an “Unshakable Bull Market” for Gold

This Stock Is Primed for an 850% Surge As Goldman Sachs Declares an “Unshakable Bull Market” for Gold

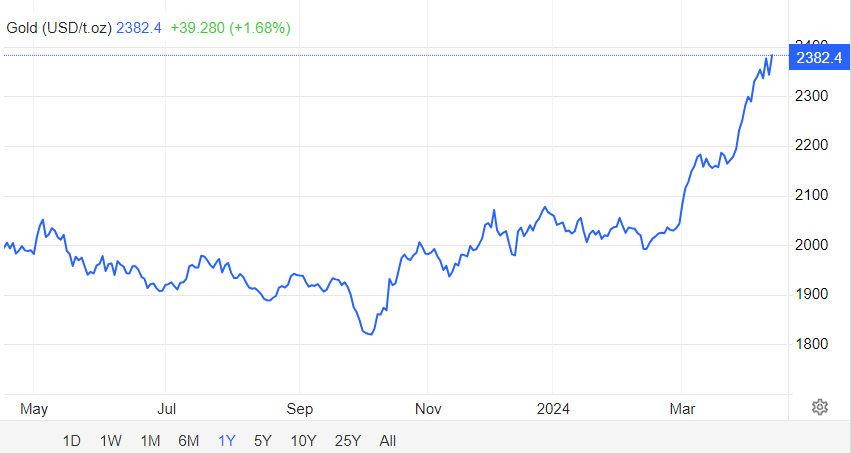

Gold prices have risen significantly and continue to rise, surging 20% over the past two months. On April 12, prices hit a record high of over $2,400 per ounce. Major institutions like Goldman Sachs (NYSE: GS) believe that gold is currently in an “unshakable bull market” and has raised the precious metal’s year-end price forecast to $2,700.

Gold is traditionally considered a safe-haven asset, offering protection against inflation, but gold mining stocks have recently started performing like growth stocks. Mining companies often outperform physical gold because they can offer potentially higher returns through increased production and cost efficiencies. The forecast for gold prices has investors looking at undervalued companies such as Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF).

Media outlets like Yahoo Finance, Investing.com, and Financial Post have reported on Bedford’s operations in British Columbia, Canada, known for its numerous gold-rich deposits.

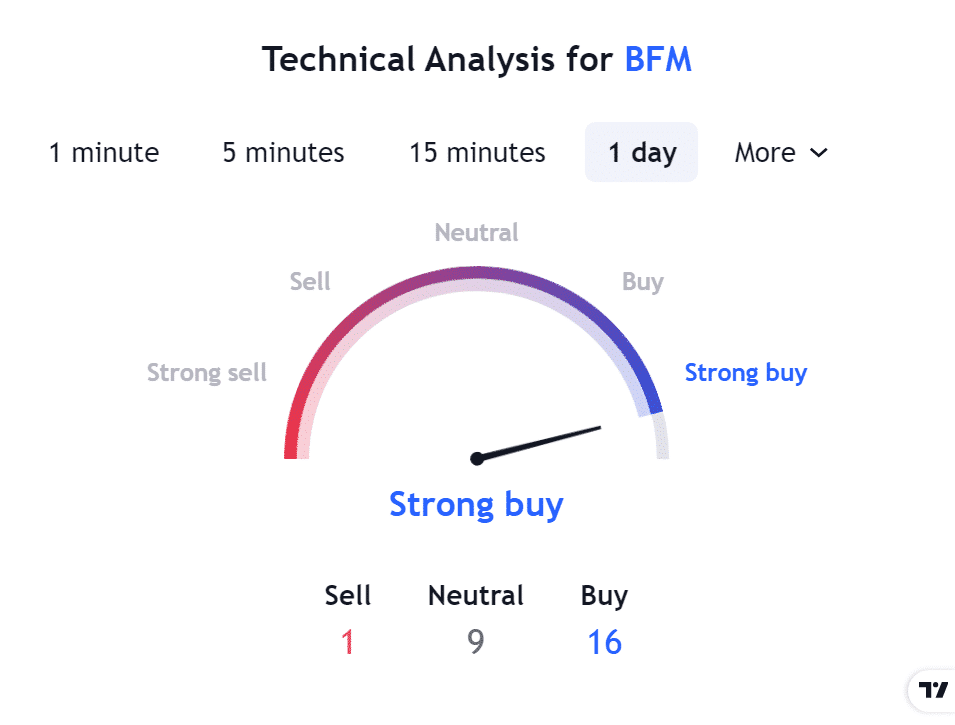

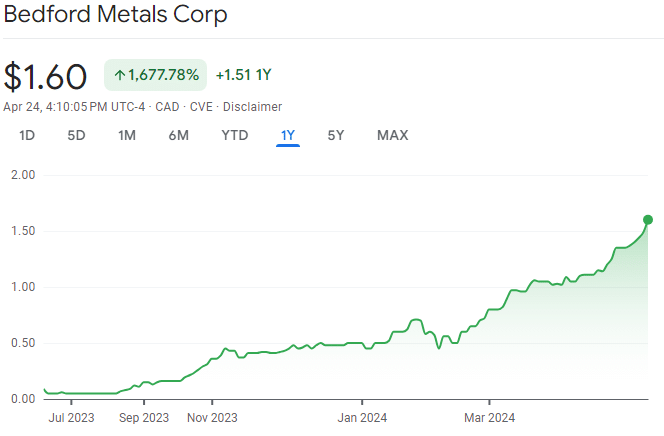

Our AI analysis recommends Bedford Metals as the gold mining stock with the greatest potential, highlighting its impressive 1677.78% growth over the past year. Based on previous geothermal surveys and AI analysis, the expected findings at the Margurete Gold Project could potentially boost Bedford’s stock value by as much as 850%.

At News by Ai, we leverage AI models to analyze stock data, news trends, and market forecasts to identify leading market stocks. Our AI democratizes professional financial insights and portfolio management, making them accessible to everyone.

Major Gold Price Breakout & New Bull Market Confirmed

Gold is widely regarded as a safe-haven asset, and astute investors often purchase it to offset some of the risk against inflation, geopolitical disturbances, and financial uncertainties. Long-term forecasts by Wall Street firms already suggest gold-backed stocks amid high interest rates are a safe investment and could heavily outperform tech stocks in the coming years.

Despite expectations of fewer Federal Reserve rate cuts, stronger economic growth trends, and record-high equity markets, gold prices have climbed 20% over the past two months. On April 12, spot gold hit a record high of over $2,400 an ounce.

In response, Goldman Sachs (NYSE: GS) has revised its gold price forecast upward to $2,700 per ounce by the end of 2024, up from its earlier projection of $2,300, declaring “an unshakable bull market” for the precious metal.

Source: Trading Economics

This is not the first time Goldman Sachs has raised its gold price forecast this year, and AI analysis suggests it may not be the last. The investment bank highlights that gold will remain stable despite recent strong market performances. This suggests that the bull market is influenced by factors beyond traditional economic elements, such as buying by central banks and private investors in Asia.

“The traditional fair value of gold would connect the usual catalysts – real rates, growth expectations, and the dollar – to flows and the price. None of those traditional factors adequately explain the velocity and scale of the gold price move so far this year. Yet that substantial residual from the traditional gold price model is neither a new feature nor a sign of overvaluation,” Goldman Sachs stated.

Anticipated cuts in interest rates by the U.S. Federal Reserve, alongside uncertainties from the U.S. election cycle, are expected to impact global markets, including commodities like gold. These cuts are expected to influence prices worldwide and continue driving gold prices upwards, reflecting its appeal during economic uncertainties.

Investing in gold stocks, like Bedford Metals, typically offers higher returns than physical gold due to the potential for operational growth and production efficiency gains. These under-the-radar stocks, which tend to be undervalued, also benefit from increasing gold prices.

Bedford Metals Is a Must-Buy Stock for 2024 with Promising Short and Long-Term Potential

Bedford Metals Corp. is a leading mineral exploration company and a promising investment for 2024. The company consistently creates shareholder value from project inception to completion through strategic project management that includes streamlined operations and targeted exploration.

The company’s stock has seen a remarkable surge, climbing 220% since the start of 2024 and over 1677% from the previous year, largely driven by escalating gold prices and strategic advancements at its key project site that have rallied investor interest.

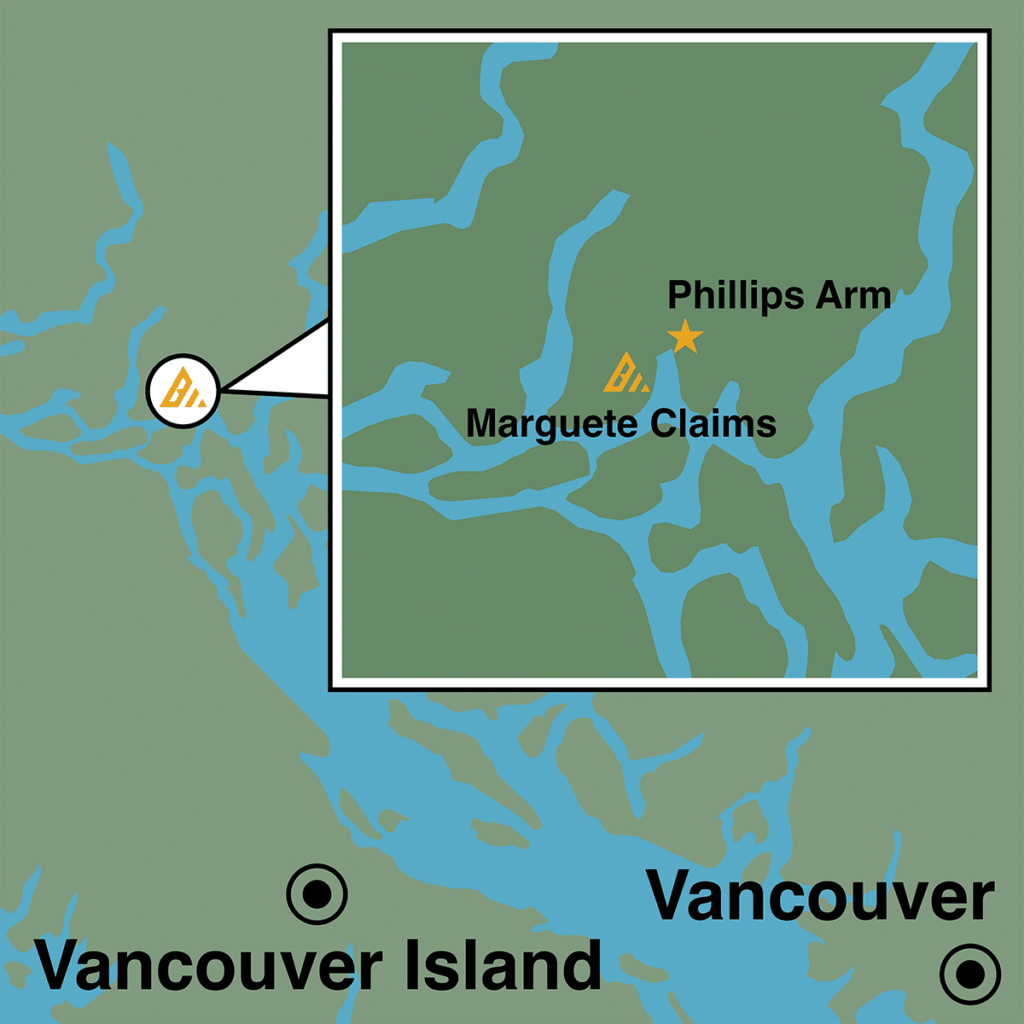

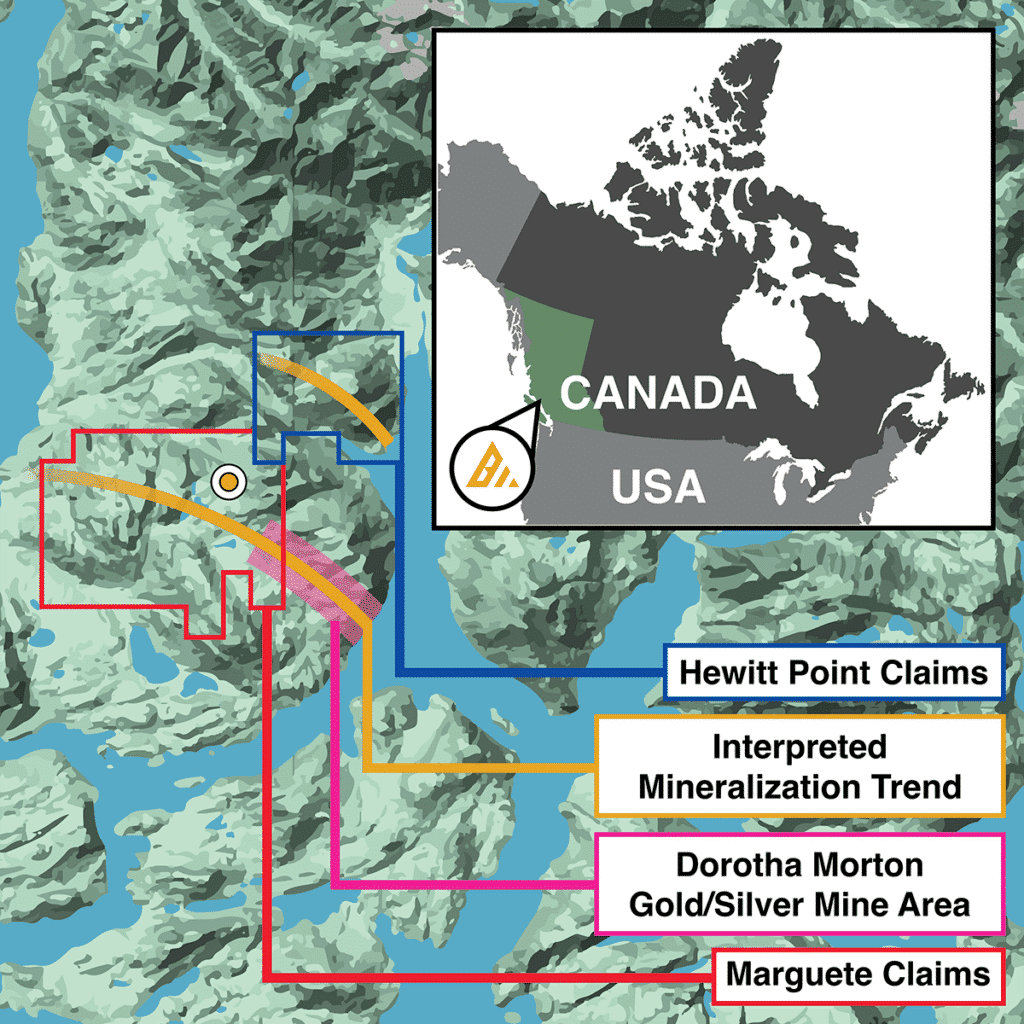

Central to Bedford’s success is its ownership of the Margurete Gold Project in British Columbia, Canada—a province known as one of the top gold-producing areas globally. The project spans 687 hectares where previous exploration efforts, including geochemical surveys and drilling, have confirmed findings of up to 6.18 grams per tonne of gold at the surface.

Bedford Metals owns a 100% interest in the Margurete Gold Project, located approximately 200 kilometres northwest of Vancouver in southwest British Columbia, Canada. It is directly connected to the prolific past of the Phillips Arm gold camp

British Columbia boasts significant gold reserves and continues to attract substantial investment. A year ago, industry reports estimated the total value of provincial mining production would reach $15.9 billion in 2023. That same year, the region saw an investment of $4.9 billion in eight new mines and expansions alone, highlighting a burgeoning and thriving mining sector.

Bedford Metals plans to continue its aggressive 2024 exploration agenda on its Margurete claims. With its stock affordably priced and expected good results from its 2024 project, Bedford is likely to see significant share price growth.

The Margurete Gold Project is close to the notable Doratha Morton mine.

In addition, Bedford is striving to diversify its mineral portfolio. The company announced that it is considering entering the uranium market in addition to its established gold ventures by leveraging Canada’s uranium-rich Athabasca Basin. This diversification towards another highly demanded metal could enhance its attractiveness and stability in the market.

Compared to its competitors in the area, like Seabridge Gold (TSX:SEA), which trades over $21, Bedford offers investors a chance to buy gold stocks at a relative discount for substantial results.

5 Main Reasons Investors Are Rallying Behind Bedford’s Stock

Long Bull Run: With gold prices at record highs and predictions of further growth, Bedford’s core business in gold mining is particularly attractive, offering potential for safe and high returns.

Strategic Location: Situated in British Columbia, Canada—a top gold-producing region—Bedford benefits from abundant gold reserves and strong mining and exploration support.

Impressive Stock Performance: Bedford Metals has experienced significant stock price growth of over 1677% in a year, greatly outperforming market expectations, which has attracted more investor interest and investment.

Exploration and Expansion Plans: The company is actively engaging in new exploration projects for its Margurete Gold Project, which has shown potential for substantial gold deposits, signalling ongoing growth and profitability. The anticipated positive outcomes from upcoming exploration results are expected to further boost the stock’s performance.

Diversification Potential: Bedford is considering expansion into other valuable mineral sectors, including uranium, within Canada’s uranium-rich Athabasca Basin, potentially broadening its market influence and investment appeal.

Savvy investors are wasting no time entering the gold bull run with stocks like Bedford. They recognize the growth potential these companies have, which is being fueled by exciting developments in gold prices, as their golden opportunity to reap massive returns.

Reply