- Tech News's Newsletter

- Posts

- This Gold Stock Continues to Outperform the S&P 500 & Is Primed for Another 850% Gain

This Gold Stock Continues to Outperform the S&P 500 & Is Primed for Another 850% Gain

As gold prices continue their historic upswing, investors keep buying gold mining stocks to cash out big on what Citi analysts call a long-term “gold rally.” April saw record gold prices of just over $2,400 an ounce, and over the past year, gold prices have risen around 15%.

Experts suggest that the gold rally is just beginning. Macro fund managers believe the factors that fueled gold’s sharp rise since mid-February will continue to propel its upward trajectory, including heightened demand from China. Goldman Sachs is doubling down on its recent bullish call, stating, “Even if rates do stay high, we expect to see continued bullish momentum in the gold price.” This statement follows their adjustment two weeks prior, raising the 12-month gold price forecast to $2,700 an ounce from $2,300.

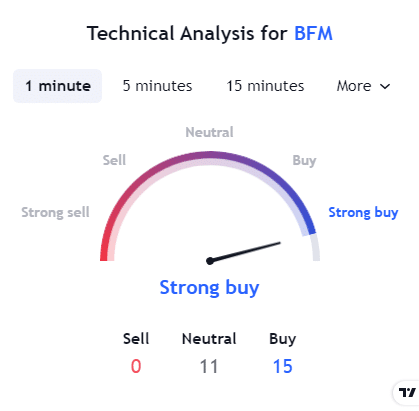

Junior gold mining and exploration companies have seen a boost in their stock price but not as much as Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) (Up over 2000% in the last year) due to their undervalued stock price, mining sites, and experienced management. This stock continues to show signs of rising at a high multiple in relation to the price of gold while continuing to mature with new project acquisitions at the end of April.

The stock has increased 187% since we first identified it as a winning stock in the gold mining sector on February 28.

Based on previous geothermal surveys and AI analysis, the expected findings at the company’s Margurete Gold Project could potentially boost Bedford’s stock value by as much as 850%.

At News by Ai, we implement AI models to analyze stock data, news trends, and market forecasts to identify leading market stocks. Our AI delivers professional financial insights and makes portfolio management universally accessible.

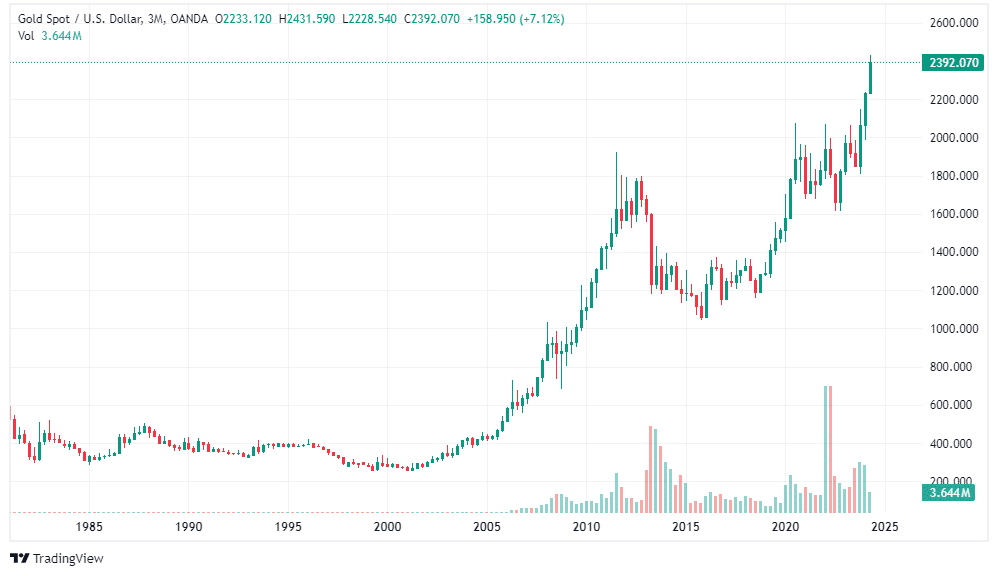

Short-Term Gold Price Increases Follow Long-Term Trends

Since the early 2000s, gold’s price trajectory has consistently shown higher highs, adhering to a robust uptrend line throughout its two-decade bull run.

In the past 4 years, gold encountered resistance between $2,000 and $2,100. However, on March 4th, it decisively closed above this zone on a surge of high trading volume. By April 12, 2024, gold prices had escalated to over $2,400 per ounce, signalling ongoing bullish momentum.

Central banks globally have been aggressively stockpiling gold, driven by factors such as geopolitical risks, inflation, and a weakening U.S. dollar. This is particularly evident in China, whose central bank has purchased more gold than any other central bank worldwide over the last 17 months. Meanwhile, Germany saw an impressive 9,034 tons of gold reported in private ownership. These strategic acquisitions underscore gold’s role as an invaluable asset and will continue to put massive upward pressure on gold prices for years to come.

As the gold market continues to strengthen, the investment case for gold and its related mining companies becomes increasingly compelling:

Gold’s Pricing and Market Dynamics: The long-term uptrend in gold prices is set to continue, with significant recent gains and more expected. Rising demand and limited new mine investments suggest a tightening supply, enhancing profitability prospects for miners.

Attractive Investment Opportunities: Due to current price levels, mining companies with strong management teams known for successful project execution are particularly appealing.

Market Valuations: The valuation of smaller gold mining companies remains depressed due to previous underinvestment, which is now correcting. This presents an attractive entry point for investors.

For investors considering capitalizing on the gold market opportunities, a diversified approach across lower market cap spectrums in the gold mining sector is advised. Focus on companies with experienced leaders and high-quality projects in favourable jurisdictions.

How to Capitalize from Rising Gold Prices Without Paying A Fraction of the Price of Gold

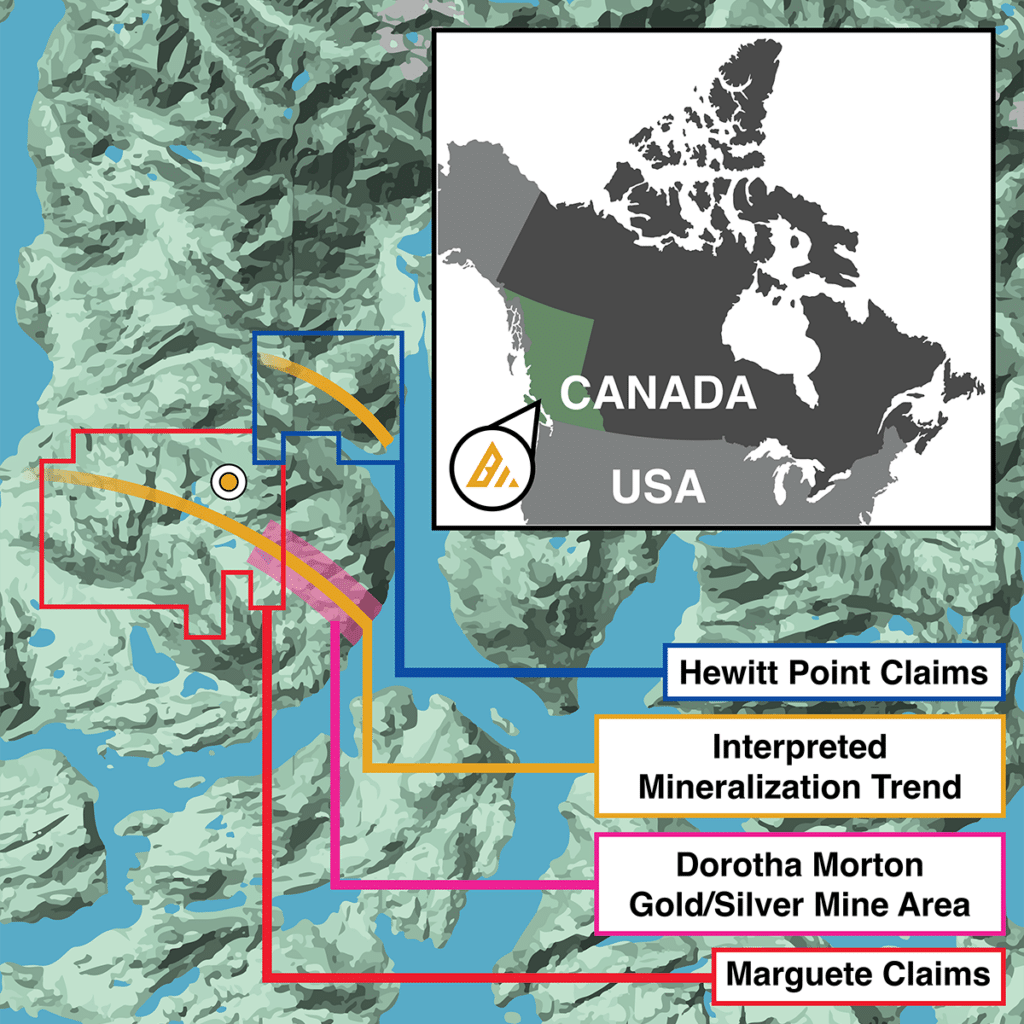

Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a mineral exploration company specializing in uncovering and developing lucrative gold deposits in British Columbia, Canada. The company has showcased extraordinary growth, with its stock value soaring 302% since the beginning of the year and an impressive 2,133% over the last twelve months.

Investing in gold mining companies like Bedford offers considerable advantages over direct investments in physical gold. As gold prices climb, companies like Bedford can scale production and optimize operations to enhance profitability. These operational efficiencies, coupled with rising gold prices, typically result in these companies’ stock prices increasing faster than the price of gold itself.

Source: Bedford Metals

The remarkable gains by Bedford are a testament to this dynamic. The company is actively advancing its operations, particularly at the Margurete Gold Project in British Columbia, where past explorations have uncovered significant gold deposits, with findings such as 6.18 grams of gold per tonne at the surface.

Bedford’s targeted exploration within the Margurete Property has unveiled remarkable grades, resonating with the historic gold rush that once thrived here.

Under the leadership of President Peter Born, who brings over thirty years of experience in exploration and mining, including project evaluation roles in senior and junior mining companies, Bedford is well-positioned for sustained growth. His expertise is instrumental as the company prepares for its ambitious 2024 exploration endeavours.

The gold market’s strong performance underpins the bullish case for investments in gold mining stocks. Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) stands out as a particularly compelling investment opportunity due to its strong performance, strategic initiatives, and potential for substantial future growth.

Given its current valuation, Bedford’s stock is an attractive option for investors looking to capitalize on the ongoing gold bull market and secure significant returns.

Reply