- Tech News's Newsletter

- Posts

- This Gold Miner’s Uranium Play Positions this Stock for an 850% Upswing

This Gold Miner’s Uranium Play Positions this Stock for an 850% Upswing

Gold and uranium are two of mankind’s most valuable and important metals, and investors are now bullish on companies that mine them.

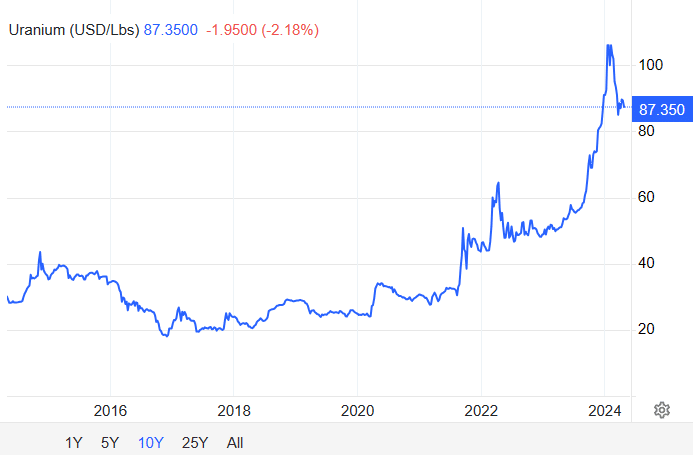

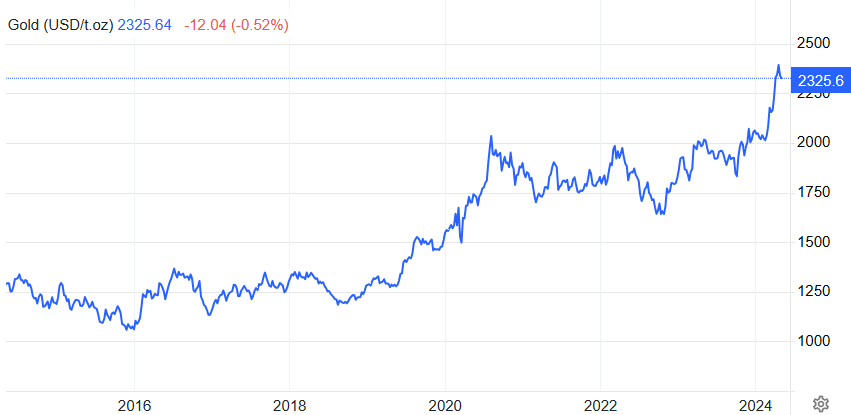

After being the best-performing commodities in 2023, gold and uranium continue to grow reliably despite market swings. This upward trend has continued into 2024, and commodity experts predict both metals could be on a bull run until 2027.

The price of gold has grown by almost 20% in the past two months, recently climbing to $2,330 per ounce. Gold’s price increased before, during, and after the pandemic and is expected to continue rising. Meanwhile, uranium prices have surged more than 60% in a year spurred by a critical supply shortage and a soaring demand for nuclear power as a sustainable energy alternative.

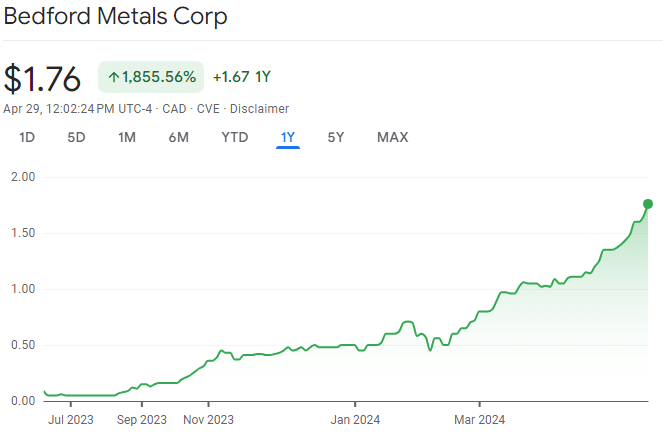

Companies like Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) understand these long-term market trends and are now adding uranium projects to their mining portfolios. Bedford’s stock is notably undervalued given its significant market potential in both gold and uranium sectors, providing investors with a significant growth opportunity and an attractive entry point.

Media outlets like Yahoo Finance, Investing.com, and Financial Post have covered Bedford Metals Corp’s operations in British Columbia, Canada, an area recognized for its abundant gold deposits.

On April 29th, media reports also highlight Bedford’s acquisition of the Ubiquity Uranium Project in the Athabasca Basin, Canada’s premier uranium mining region.

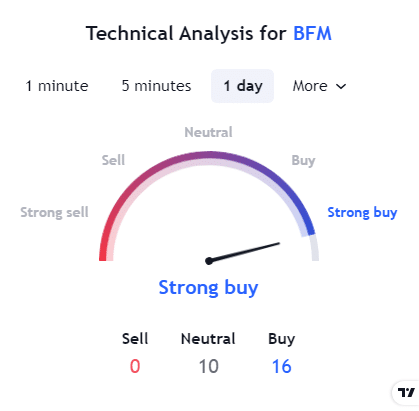

Our AI-driven analysis at News by Ai continues to rank Bedford Metals as the top mining stock, highlighted by an astonishing growth of over 1855% over the past year. The promising developments at the Margurete Gold Project and recent strategic ventures into the uranium market are projected to propel Bedford’s stock value by as much as 850% in 2024. Having already achieved a 252% growth this year, our AI forecasts suggest a robust upward trajectory for the stock.

At News by Ai, we harness advanced AI models to sift through stock data, news trends, and market forecasts, enabling us to pinpoint lucrative market opportunities. Our AI democratizes professional financial insights and portfolio management strategies, making them accessible to everyone.

Uranium’s Rising Demand in the Energy Sector Propels Prices

Uranium has become increasingly important as governments intensify their search for nuclear power solutions to meet net zero targets. “The shift towards emission reduction through electrification creates a higher demand for stable, carbon-free power sources, which intermittent sources like wind and solar cannot satisfy.

The World Nuclear Association reports that approximately 60 new nuclear reactors are under construction globally, with another 110 planned in the coming years. In Canada, owners of dormant uranium mines are reactivating them to capitalize on the increasing demand as prices are anticipated to soar.

After years of delayed nuclear projects in the 2010s, the uranium market has rebounded and strengthened year over year, signalling a robust future for this critical energy resource.

Source: Trading Economics – Uranium Spot Price

In addition, the lack of uranium mine development has led to a tightened market and reduced production, causing a supply deficit that is likely to drive up prices as new nuclear plants are constructed worldwide.

This rising market is significantly increasing investment in historic uranium-producing regions like Canada’s Athabasca Basin. The International Atomic Energy Agency (IAEA) projects that by 2040, global uranium needs will exceed 100,000 metric tons annually—more than double the current production levels.

Most of the world’s uranium comes from Kazakhstan, Canada, Namibia, and Australia. The surge in demand is likely to enhance Canada’s contribution even further. Smaller mining operators with previously non-viable or underdeveloped mines are now finding the economics more favourable due to higher prices.

Advances in technology and new extraction methods are poised to revolutionize the uranium mining sector, enabling companies like Bedford Metals to access new deposits more efficiently and cost-effectively.

Gold Mining Stocks Profit the Most in a Gold Bull Market

Gold’s price surge to a record $2,400 per ounce in early April signals a potential climb towards $3,000 driven by increasing U.S. debt, geopolitical tensions, lower interest rates, and strong central bank acquisitions. Investors now face the most compelling opportunity in years to leverage grains through gold stocks.

Source: Trading Economics – Gold Spot Price

The anticipated shift towards lower interest rates is projected to favour gold, sustaining its popularity among investors as an inflation hedge. Its ability to diversify portfolios has led to the introduction of various investment forms over the years, including minted coins and bars, gold bonds, digital gold, and funds such as ETFs and mutual funds.

Yet, the most rewarding investments are often found in gold mining stocks. These companies can expand production and reduce costs, enhancing profitability. As a result, their earnings growth, coupled with rising gold prices, tends to propel their stock prices faster than the price of gold itself.

The recent rise in gold prices has particularly favoured mining companies with skilled management, promising projects, and strong operational strategies. As the mining sector continues to evolve with technological advancements, companies like Bedford Metals are well-positioned to capitalize on these opportunities.

The Uranium and Gold Stock With 850% Upside Potential

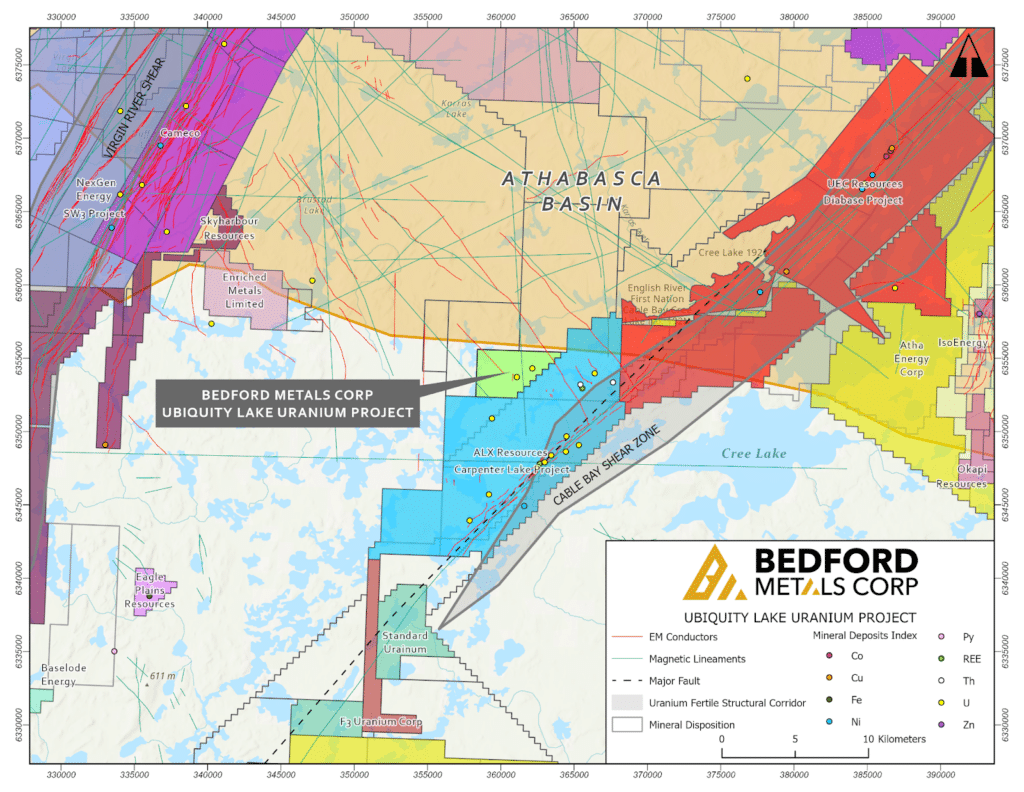

Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a leading mineral exploration company and a promising investment for 2024. Bedford announced on Monday, April 29, the acquisition of the Ubiquity Lake Uranium Project in the renowned Athabasca Basin, Canada’s top uranium-producing region. This 1,382-hectare project is positioned just south of the Athabasca Basin’s edge, adjacent to ALX Uranium‘s Carpenter Lake Project and Uranium Energy Corp’s Diabase Project.

Source: Bedford Metals Corp.

It benefits from proximity to significant geological features like the Cable Bay Shear Zone and is parallel to the Virgin River Shear Zone, home to Cameco’s Centennial uranium deposit. Additionally, it’s only 100 km west of Cameco’s historic Key Lake uranium mine, enhancing the project’s strategic value and potential for significant uranium discoveries.

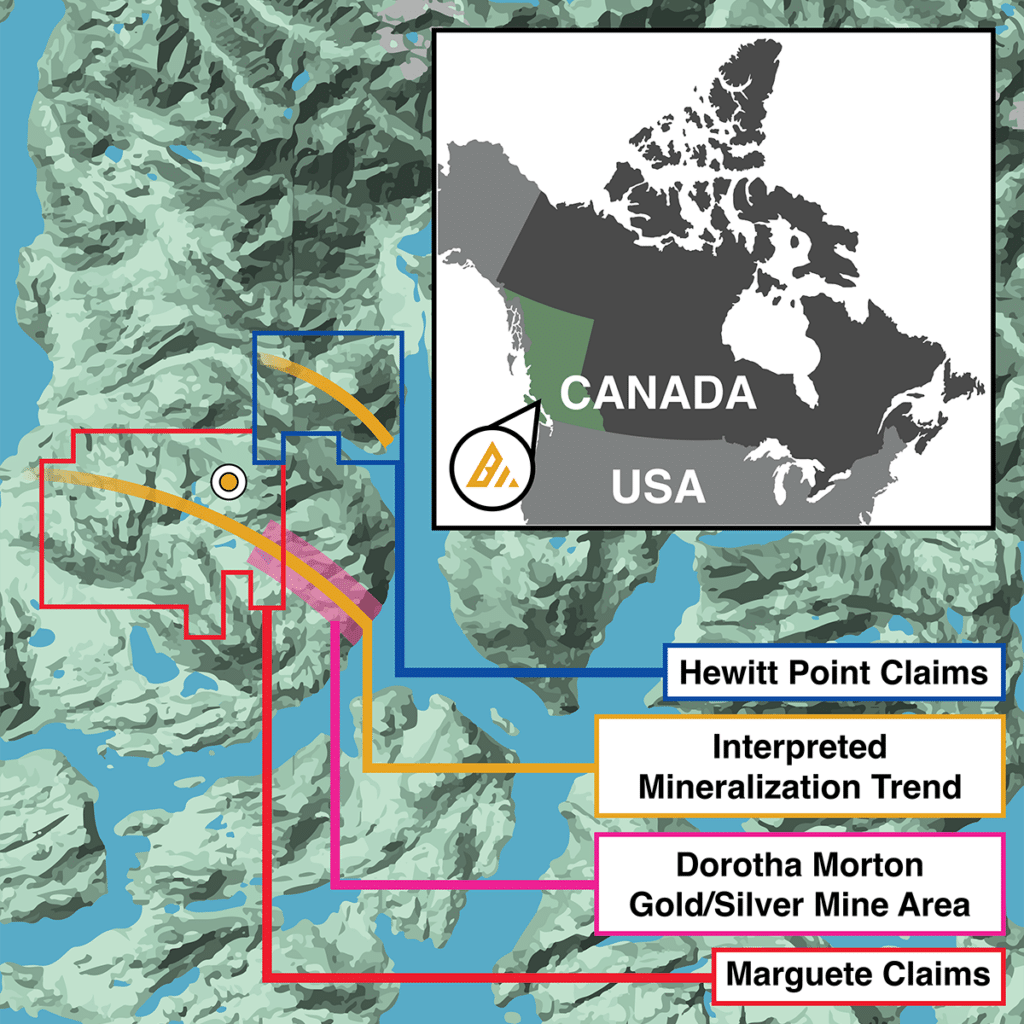

Bedford’s success is also rooted in the Margurete Gold Project in British Columbia, Canada—a globally recognized gold-rich area. The project, covering 687 hectares, has yielded promising results from initial surveys and drilling, finding gold concentrations of up to 6.18 grams per tonne at the surface.

Source: Bedford Metals Corp.

Bedford Metals plans to continue its aggressive 2024 exploration agenda. With its current affordable stock price and expected good results from its 2024 exploration project, Bedford is likely to see significant share price growth.

5 Reasons To Add Bedford Metals to Your Portfolio

Strong Potential in Booming Gold and Uranium Markets: Bedford Metals is actively involved in the gold and uranium sectors, which are currently experiencing significant growth. With gold prices at record highs and increasing uranium demand for clean energy, Bedford is well-positioned in two of the most promising commodity markets.

Recent Expansion into High-Demand Uranium Sector: The company has strategically entered the uranium market by acquiring the Ubiquity Uranium Project in Canada’s premier uranium region, the Athabasca Basin. This move allows Bedford to tap into the global surge in demand for uranium, driven by an increasing number of nuclear power projects and the need for stable, carbon-free energy sources.

Promising Gold Exploration Project: Bedford’s Margurete Gold Project in British Columbia has already yielded promising results, showcasing the potential for significant gold extraction. This project lies in a renowned gold-rich area, enhancing the prospects for successful and profitable mining operations.

Market Valuation and Growth Potential: Bedford Metals’ recent performance shows a 252% increase since the beginning of 2024, and further growth is anticipated. The bullish outlook on gold and uranium markets suggests a continued upward trajectory for the company’s stock as they dive into this year’s exploration projects.

Geographical and Commodity Diversification: Bedford Metals mitigates investment risks associated with market volatility and geopolitical instability by operating in gold and uranium markets and expanding its projects in geopolitically stable Canada. This diversification enhances the company’s market presence and provides a buffer against fluctuations in any single commodity market.

Informed investors are capitalizing on the rising gold and uranium markets by investing in companies like Bedford Metals, which are poised for substantial growth. They understand these companies’ significant growth potential, driven by commodity prices and uranium’s emergence as a key future energy source. This represents a prime chance for investors to achieve substantial returns at a relatively discounted price before the stock inevitably rises.

|

Reply