- Tech News's Newsletter

- Posts

- Goldman Sachs, Hedge Funds Race to Buy Uranium as US Stops Russian Imports: How Investors Are Cashing In

Goldman Sachs, Hedge Funds Race to Buy Uranium as US Stops Russian Imports: How Investors Are Cashing In

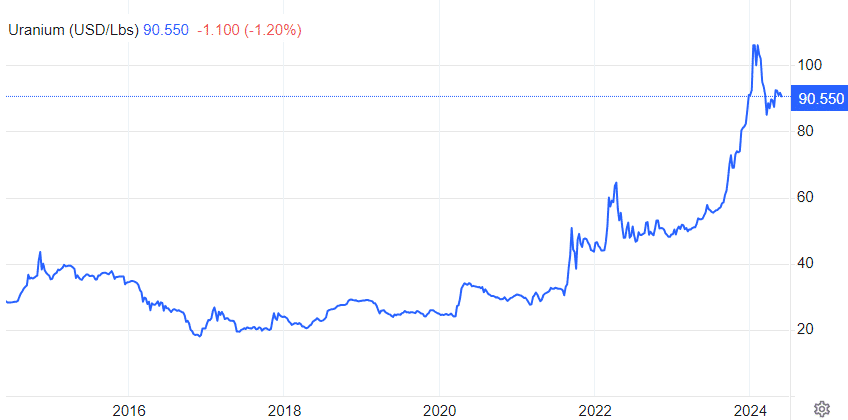

A U.S. ban on enriched uranium imports from Russia will take effect on Aug. 11, 2024. This decision is kicking the already bullish uranium market into overdrive, with Goldman Sachs and hedge funds racing to buy uranium and uranium producers. Existing supply shortages have already caused uranium prices to spike over 65% year-over-year. With the rise of AI and EVs, global electricity demand is soaring, making nuclear energy a preferred solution for both investors and policymakers.

Major US banks agree that uranium prices will grow in 2024 and 2025. With uranium spot prices currently at over $90/lb, Bank of America forecasts that prices will reach $105/lb this year and $115/lb in 2025. Citibank is more bullish, forecasting a uranium price of $151/lb in 2025.

Large tech firms are also heavily investing in nuclear energy. Microsoft has signed a contract to buy nuclear-generated electricity for its eastern U.S. data centers, while Amazon has invested $650 million to acquire a nuclear-powered data center in Pennsylvania.

In Europe, UBS Group’s billionaire clients continue to bet on the energy sector to offer the biggest opportunities over the next five years. Half of the ultra-high net worth clients surveyed by the bank stated that energy is the most attractive sector for future investment returns and business.

Underpinning this uranium bull run are mining stocks with high growth potential, such as Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF), operating in Canada’s Athabasca Basin, which has supplied the U.S. with uranium for over 70 years.

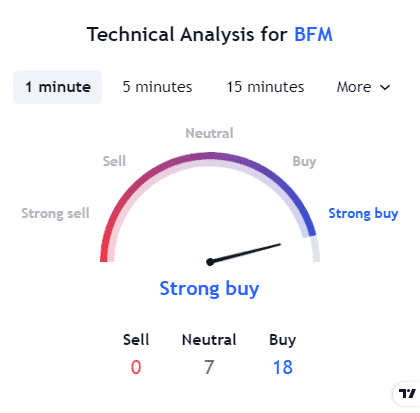

TradingView – Technical Analysis for BFM

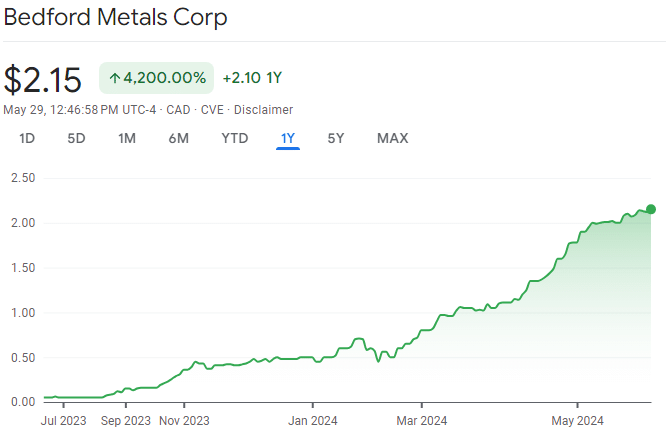

Based on AI-driven analysis, stock performance, and market trends, News by Ai ranks Bedford Metals as the top mining stock for 2024. The company’s stock price has shown an impressive 4,200% growth over the past year due to its strategic acquisitions in the Athabasca Basin.

Current exploration and further expansion are anticipated to increase Bedford’s stock price by 800% in 2024. Having already achieved a 330% growth this year, our AI forecasts a robust upward trajectory for the stock as the company expands.

At News by Ai, we use AI models to analyze stock data, news trends, and market forecasts to identify top-performing stocks.

Uranium Is Booming, and Savvy Investors Are Starting to Seize the Bull by the Horns

Uranium was one of the strongest-performing commodities in 2023, returning almost 90%. In January, uranium prices climbed, reaching $106/lb before correcting to over $90/lb. It is expected to climb further in the next 90 days due to the recent U.S. nuclear energy policy.

Trading Economics – Uranium Spot Price

The supply of uranium worldwide has been fragmenting in recent years. The recent ban on Russian uranium is not the only factor reducing supply. Instability in Niger, one of the few uranium-producing countries, is affecting uranium prices on the supply side.

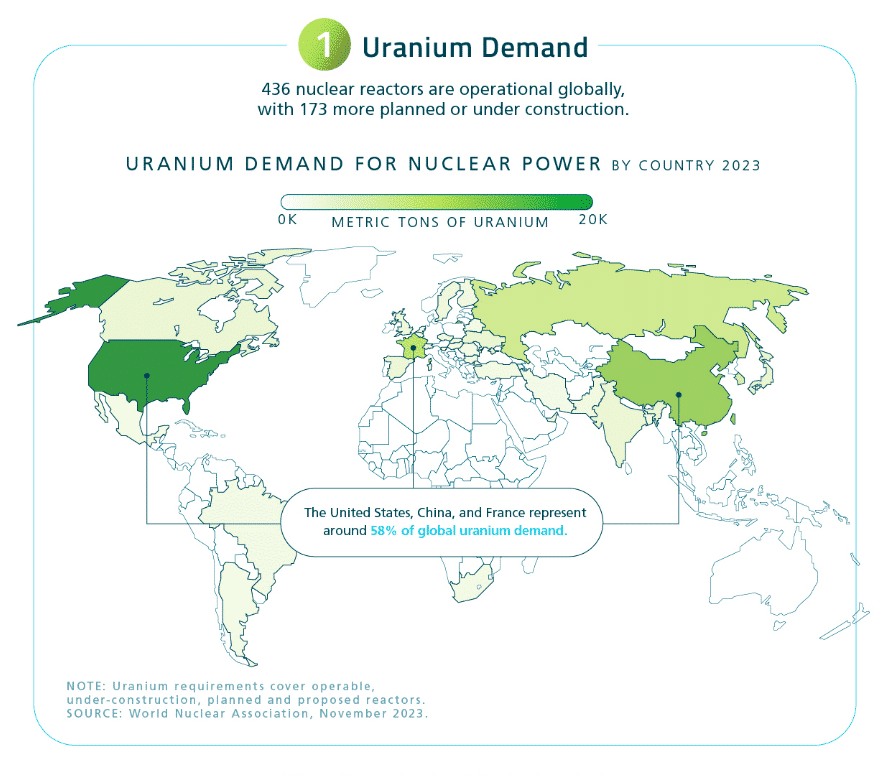

On the demand side, the ongoing surge in energy consumption from AI data centers means that major tech firms like Microsoft, Google, and Amazon are investing in nuclear options to meet their energy needs. Electricity demand for data centers in the UK is predicted to increase sixfold over the next decade. Major countries, including the U.S., have pledged to triple nuclear energy capacity from 2020 to 2050.

Sprott ETFs – The Global Uranium Market in 3 Charts (Chart 1)

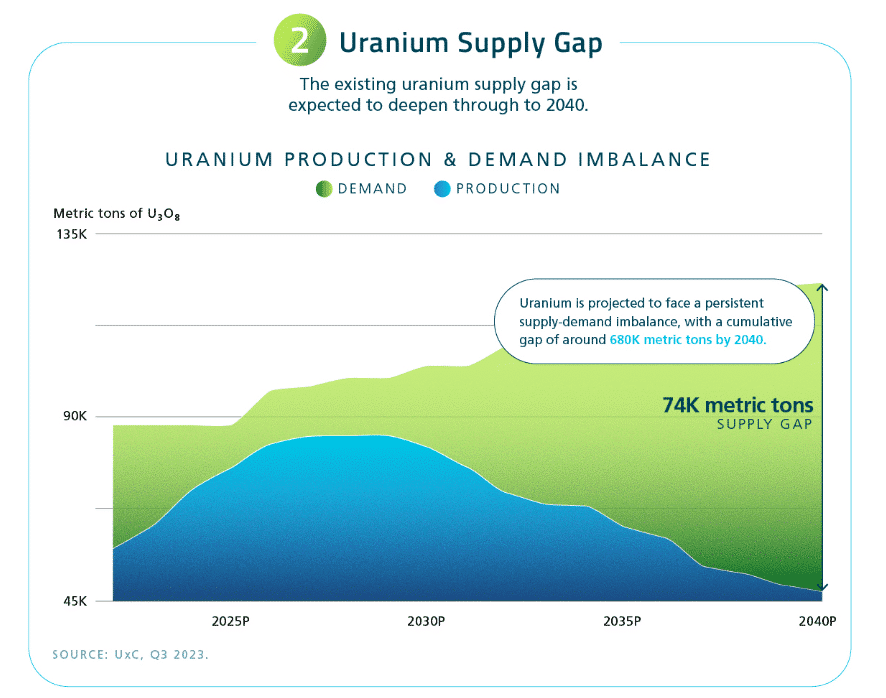

Currently, nuclear power generates 10% of the world’s electricity. The World Nuclear Association reports that approximately 60 new nuclear reactors are under construction globally, with another 110 planned over the next few years. The International Atomic Energy Agency (IAEA) projects that by 2040, global uranium needs will surpass 100,000 metric tons annually, more than double current production levels.

Sprott ETFs – The Global Uranium Market in 3 Charts (Chart 2)

On average, uranium companies have seen rising stock prices due to recent market trends. The North Shore Global Uranium Mining Index (URNMX), which tracks companies with at least 50% of assets in uranium mining and related activities, gained 95% in the past year.

Uranium miners have historically outperformed the commodity during bull markets. Savvy investors have taken advantage of the uranium bull run by buying junior mining stocks like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF), which has proven to outperform their neighbours in the Athabasca basin.

The Best-Performing Uranium and Gold Stock Continues to Grow Through Acquisitions

Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a junior mineral exploration company with significant growth potential in 2024 due to its existing projects and strategic acquisitions. Its stock has already experienced an impressive 4,200% increase in the past year and 330% year-to-date as the company continues to expand rapidly.

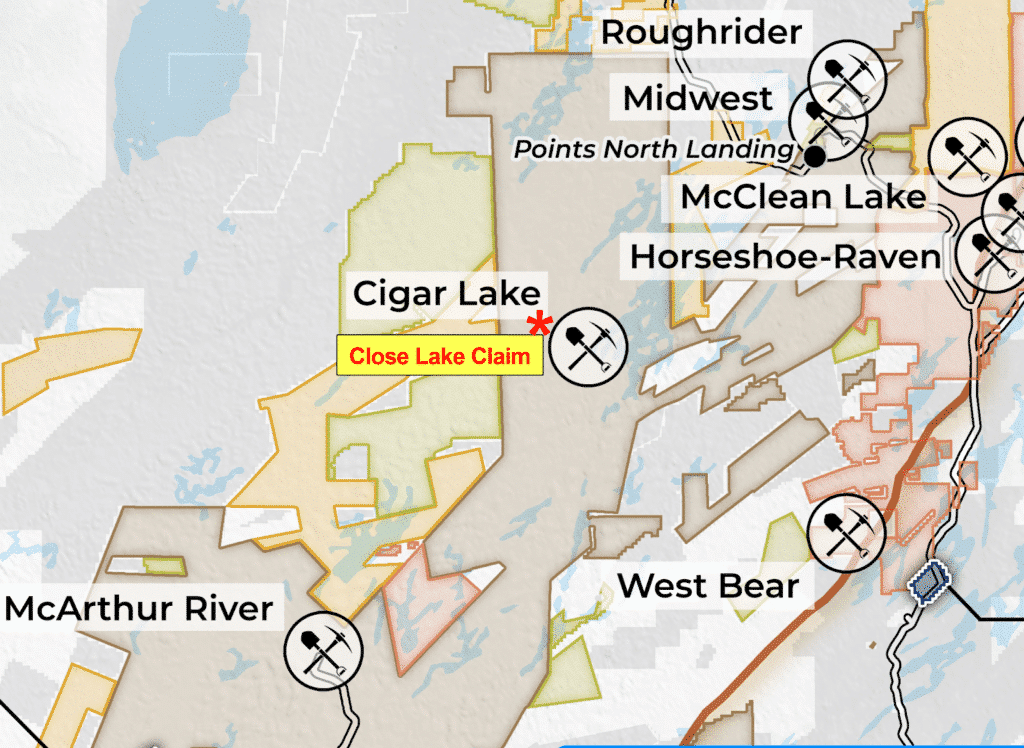

On May 21, Bedford announced the acquisition of the Close Lake Uranium Project in the Athabasca Basin, Canada’s leading uranium-producing region. This marks the company’s second uranium acquisition this year, following its acquisition of the Ubiquity Lake Uranium Project in April.

Bedford’s Close Lake project is located on the eastern side of the Athabasca Basin. The 245-hectare claim is situated in a prime exploration corridor, known for its rich uranium deposits and proximity to the productive Cigar Lake and McArthur River mines. Cameco’s McArthur River mine, the world’s largest and highest-grade uranium deposit, contains 255 million pounds of U3O8 with an average grade of 17.33%.

Bedford Metals – Close Lake Claim

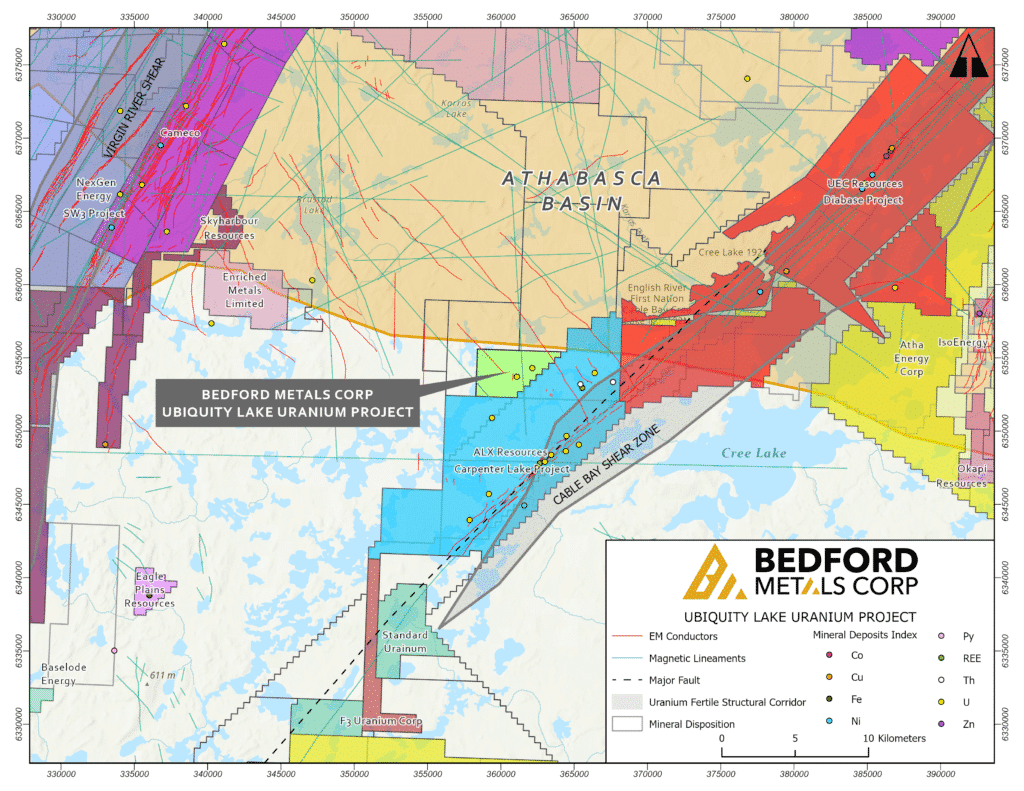

The company’s Ubiquity Lake project is adjacent to major uranium projects such as ALX Uranium’s Carpenter Lake Project and Uranium Energy Corp’s Diabase Project. The project is also close to Cameco’s Centennial uranium deposit, located near key geological formations such as the Cable Bay Shear Zone and the Virgin River Shear Zone.

Bedford Metals – Ubiquity Uranium Claim

Bedford Metals recently announced a multi-phase work program for the Ubiquity project involving VTEM (Time Domain Electromagnetic) surveys in Phase 1 and ground radiometric surveys in Phase 2.

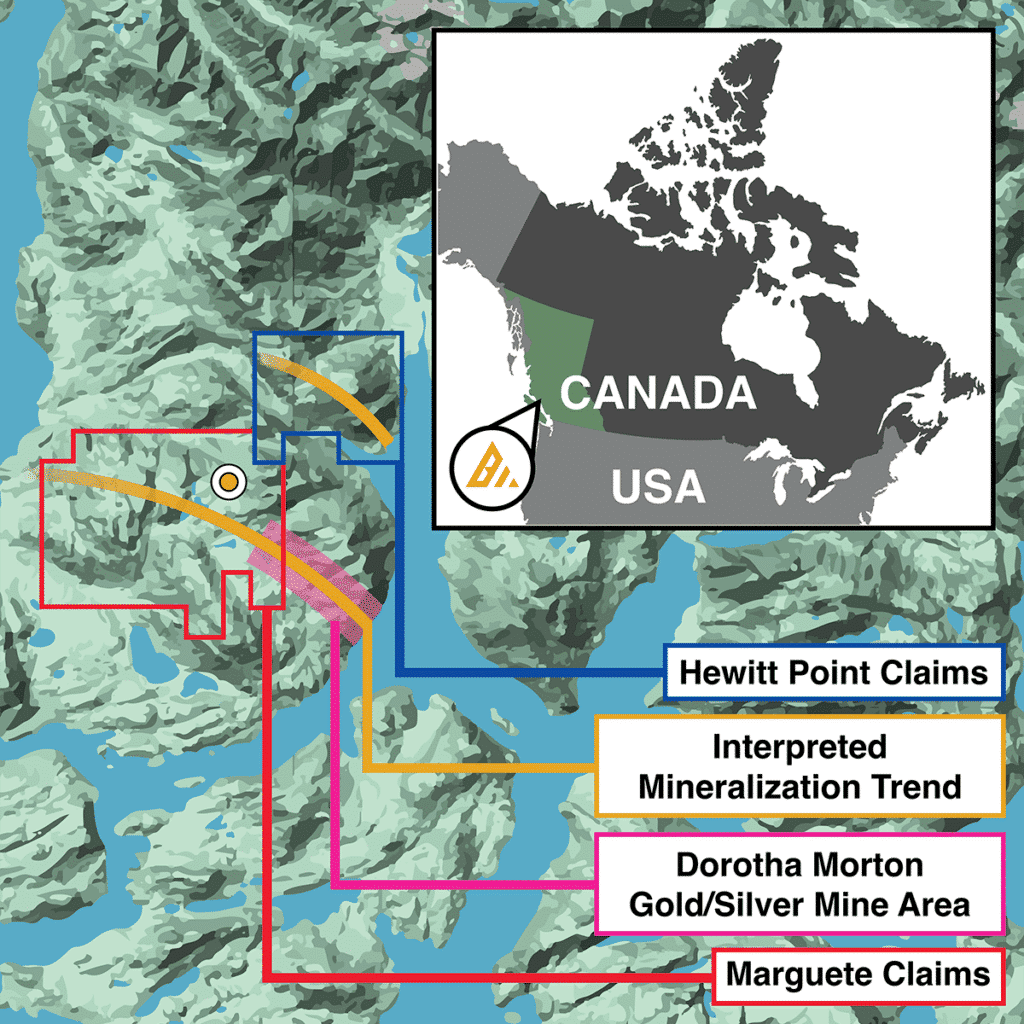

Bedford’s success was initially attributed to the Margurete Gold Project in British Columbia, Canada, a region renowned for its rich gold deposits. The project, covering 687 hectares, has yielded promising results from initial surveys and drilling, finding gold concentrations of up to 6.18 grams per tonne at the surface.

Bedford Metals – Marguerite Gold Claim

According to Bedford’s press releases, the company plans to continue its intensive 2024 exploration agenda. With its current undervalued stock price and its calculated expansion efforts, Bedford is poised for significant share price growth.

As the demand for uranium skyrockets, investing in the nuclear energy market will offer profits for everyone: including retail investors, major banks, billionaires, and tech companies. While the clean power generated from nuclear energy will benefit all of society in the future, it will benefit early investors the most.

|

Reply