- Tech News's Newsletter

- Posts

- China Hoards Uranium as Western Investors Seize Market Opportunities

China Hoards Uranium as Western Investors Seize Market Opportunities

The uranium market faces a significant supply deficit, with existing mines and projects unable to meet future demand. China has stockpiled a decade’s worth of uranium for its strategic needs while continuing to buy up international supply. Meanwhile, the US is playing catch up as government and private sector companies invest in a new fleet of nuclear reactors amongst sanctions imposed on Russian uranium.

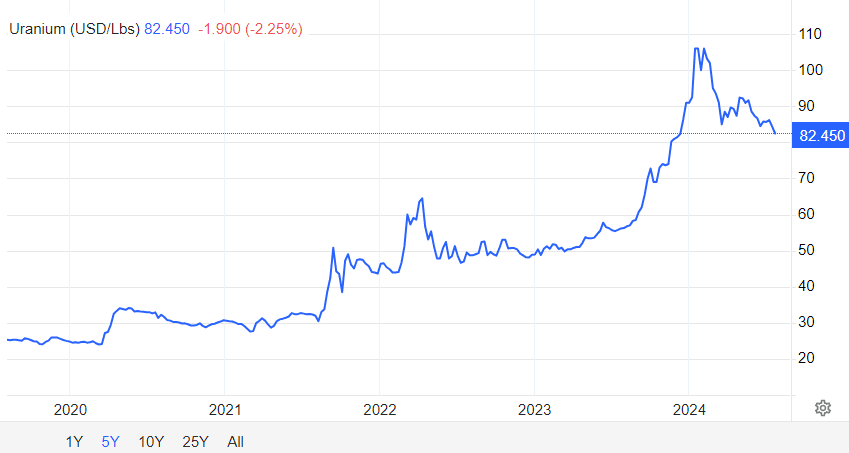

The perfect storm is brewing as the AI arms race compels nations to ramp up energy production to remain competitive. This creates a unique opportunity for investors to profit from the traditionally stable utility sector as if they were investing in tech stocks. Uranium prices have increased by over 233% in the last five years, highlighting the rapid global shift towards nuclear power.

This year, Japan added uranium to its critical minerals list, with policymakers aiming to restart more reactors that have been idle for decades. Meanwhile, France has lost its primary source of uranium due to geopolitical tensions with Niger, which has the country turning to its other source, Canada, for more production.

By 2040, the supply of uranium may meet only 50% of potential demand, even if current mines are restarted and all planned mines are fully developed. This scenario is expected to support uranium prices in the long term. By hoarding uranium, China is safeguarding its future energy supply from geopolitical risks. Meanwhile, governments and tech companies worldwide are turning to nuclear energy to reach net-zero goals and sustain their AI advancements.

Canada will be one of the biggest winners from this bull run, as the majority of its uranium resources are in high-grade deposits, around 100x the world average. As uranium prices rise, companies with anticipated or proven deposits in the Athabasca Basin will benefit the most. Savvy investors are positioning themselves for early gains by investing in undervalued uranium stocks with proven track records and strong future potential, such as Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF).

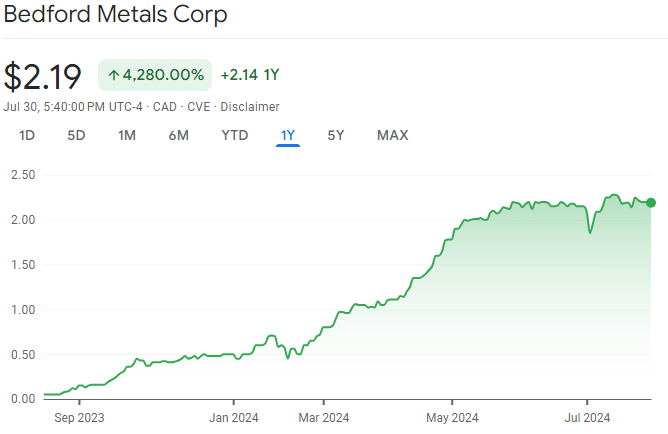

Based on an AI-driven analysis of uranium market trends, News by Ai ranks Bedford Metals as the top uranium mining stock opportunity for 2024. The company’s stock price has surged 4,280% over the past year due to its recent strategic acquisitions in the Athabasca Basin. Despite this surge, the stock remains relatively undervalued compared to its peers.

The uranium bull market has just begun, with prices expected to climb steadily. This is the perfect moment to invest in a company like Bedford Metals, poised for extraordinary growth. Current exploration and expansion efforts are expected to propel Bedford’s stock price by 850% in 2024.

At News by Ai, we use AI models to analyze stock data, news trends, and market forecasts to identify top-performing stocks. Investment banks like JP Morgan have already deployed AI-assisted investment decision tools such as IndexGPT to find lucrative stock opportunities by analyzing financial news and trends.

China Likely to Surpass US Nuclear Capacity by 2030

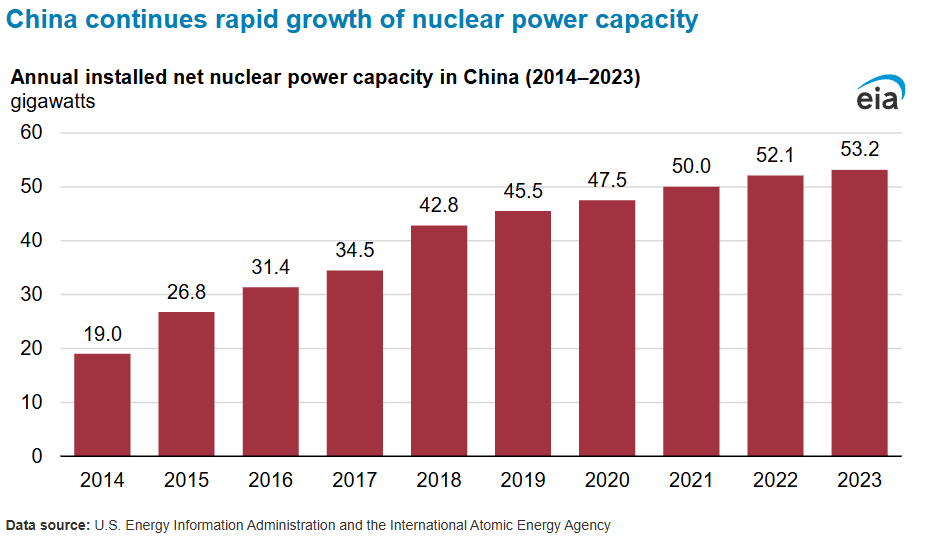

China plans to construct 150 new nuclear reactors by 2035, with 27 already underway. Each reactor’s average construction time is around seven years, significantly faster than most other countries. This positions China to surpass US nuclear capacity by 2030.

The US has the largest nuclear fleet with 94 reactors, but China took 10 years to add the same nuclear power capacity that the US took nearly 40 years to achieve. The International Energy Agency reported that China added over 34 GW of nuclear power capacity in the past decade, nearly tripling its capacity and boosting uranium demand.

Government oversight has been crucial for China’s nuclear sector, as all nuclear companies are state-owned enterprises They recently began constructing its largest uranium production project to boost energy security and unveiled the world’s first meltdown-proof reactor.

China’s uranium imports remain higher than domestic demand as the country tightens its grip on commodities. The China National Uranium Corporation has signed several joint mining ventures with operators in Kazakhstan, the world’s top uranium-producing country. These ventures give China rights to nearly 60% of Kazakhstan’s future uranium production, further constraining the global production pipeline.

Where Will New Uranium Supply Come From?

The US and twenty other countries plan to triple their nuclear power by 2050. Meanwhile, billionaire-backed nuclear tech companies such as Bill Gates’ TerraPower and Sam Altman’s Oklo are investing billions of dollars in the nuclear energy sector to meet the growing energy needs of AI data centers.

As the nuclear industry is fueled by billionaires and government dollars, uranium producers face a supply bottleneck that has increased prices by over 233% in the past five years.

Source: Trading Economics

Canada is poised to become an even bigger supplier of uranium, primarily due to its rich deposits in the Athabasca Basin. This region, located in Saskatchewan, is renowned for its exceptionally high-grade uranium ores, with concentrations around 100x higher than the global average.

These high-grade deposits make extraction more efficient and economically viable, positioning Canada as one of the top players in the global uranium market. This has attracted numerous exploration and development projects to the Athabasca Basin, ensuring a steady increase in production capacity from mining companies.

Rising commodity prices are prompting these companies to focus on growth through new projects, expansions, mergers, and acquisitions. Many of these companies, particularly junior miners, have undervalued stock prices relative to the uranium they produce. Some junior mining stocks are starting to behave like growth stocks, making now an ideal time to invest in them before their stock prices increase further.

Become an Early Investor in the Future of Energy With This Stock

Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) is among the best stocks our AI discovered when identifying stocks with the highest potential returns. Bedford’s stock has soared over 338% since the start of the year and an impressive 4,280% over the past 12 months.

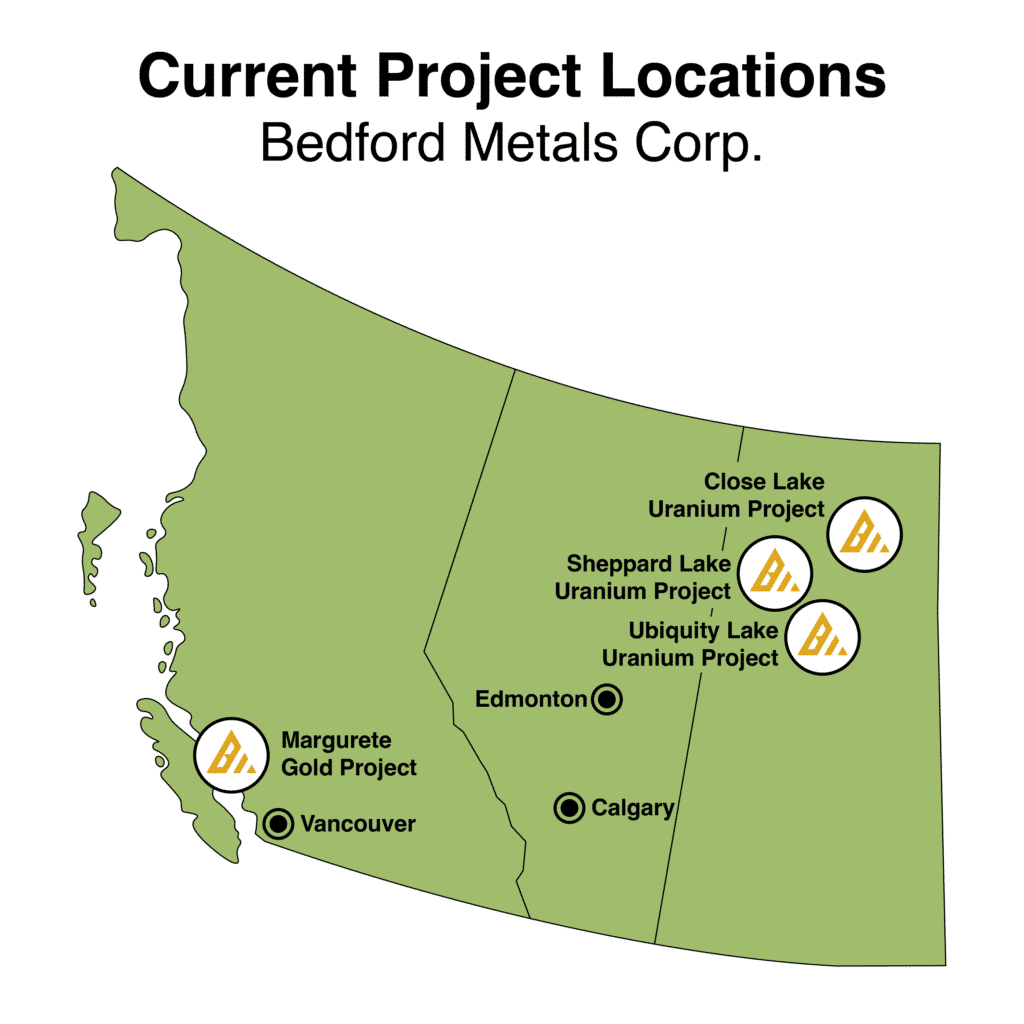

Its strategic acquisitions of three new uranium projects in the Athabasca Basin have positioned Bedford to multiply in value as the uranium bull market continues to reach new highs. These projects are close to world-class uranium deposits like Cameco’s Cigar Lake and McArthur River mines, with McArthur River being the world’s largest high-grade uranium deposit. These prime locations place Bedford in a highly successful mining region just as uranium demand hits new highs.

Bedford is also advancing its Margurete Gold Project in British Columbia, where proven gold and copper reserves will continue to drive growth. Gold is another commodity on a bull run, with its prices breaking records and outperforming most major asset classes this year. Bedford’s diversified project portfolio positions it as the leading junior mining stock to capitalize on the rising demand for uranium and gold. This creates the perfect script for a dual commodity success story for the company and its early investors.

Whether it’s environmental, technological, or geopolitical reasons, all roads lead us to a nuclear-powered world that will require unprecedented amounts of uranium. Canada is forecasted to become the number one exporter of uranium by 2023, with companies like Bedford leading the sector.

Similar to the reactors that use uranium, buying and holding companies like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) will power your portfolio for decades to come.

|

Reply